In March, Aptos blockchain created quite a buzz in the crypto industry by attracting VC’s to the field. Aptos made headlines when it received funding from prominent VC’s like a16z, FTX Ventures, Coinbase Ventures, Binance Labs, PayPal Ventures, and many more. Following this $200 million round, Aptos raised another $150 million, with FTX and Binance leading the way.

With the flood of investors dollars, the ex-Meta employees’ company crossed over $2 billion in valuation. Living up to the lofty valuation, Aptos stated its goal of becoming the home for Web3.

What is Aptos Blockchain?

Aptos is a Layer 1 blockchain that promises users increased scalability, reliability, security, and usability. It uses key elements of the former Diem blockchain and a Rust-based programming language Move.

The Aptos blockchain uses a byzantine fault-tolerant (AptosBFT) and proof-of-stake consensus to enable validators to collectively receive and process user transactions. Token holders stake by delegating tokens to their selected validators to participate in the consensus process.

Aptos claims it can process 130,000 transactions per second (TPS) while maintaining security and reliability.

The Public Outrage on Aptos

Since its launch, Aptos has been highly criticized by everyone. Users have found Aptos’ claims to be overhyped. Aptos blockchain is way slower than proclaimed and their tokenomics are also quite ambiguous, which has created a fear in the trading circle.

The Aptos Transaction Speed Debacle

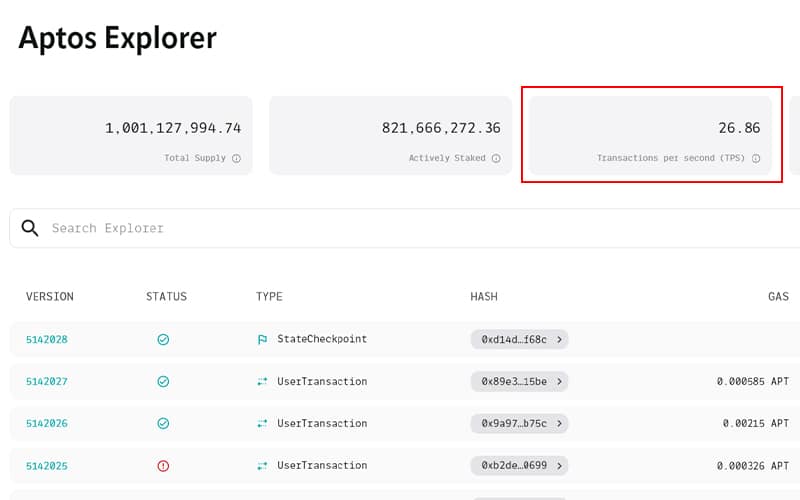

Aptos had claimed that it could process 130,000 TPS, but after its mainnet launch, users have found that it is nowhere near that speed. Even at this moment of writing, the current TPS of Aptos is only 26.86.

After examining the Aptos blockchain via its explorer, various analysts found that the majority of the transactions on Aptos are not actual transactions. They are merely validators, communicating and setting block checkpoints and writing metadata to the blockchain. It’s hard to see how users can even use Aptos right now.

If the transaction speed blunder wasn’t enough, Aptos lab revealed a tokenomics that favored VC’s and core team members to the brink. The crypto community had only 51% of tokens available, the rest were pre-reserved.

The VC favored Tokenomics

One billion Aptos tokens (APT) were initially available on the mainnet. From this, over 80% of the token supply is currently staked. Which usually looks like a good thing, but hold on, for there is a discrepancy here.

For that, let’s understand how APT was distributed in the community. At first, 190 million tokens were given to the core contributors. The Foundation received 165 million tokens, and around 134 million tokens were given to the investors.

All totaled, this amounts to 49% of the total token supply, leaving 51% for the community.

The problem here is that Aptos had no airdrop or any other way to earn these tokens before the exchange listing when the chain went online. So where did these 30% tokens come into play? One simple explanation is that these tokens were given to private parties before exchange listings.

Speaking of exchanges, these tokens were very quickly listed. It shouldn’t come as much of a surprise because FTX and Binance, two important exchanges, were already involved in Aptos’ fundraising round.

On top of all this, 51% of the tokens available for the community are currently held by the Aptos Foundation and Aptos Labs. The Aptos Foundation is holding 410 million tokens while Aptos Labs is holding the remaining 100 million tokens.

This partial tokenomics gave rise to another fear in traders, resulting in more backlash on the Aptos blockchain.

Fear Of Pump and Dump

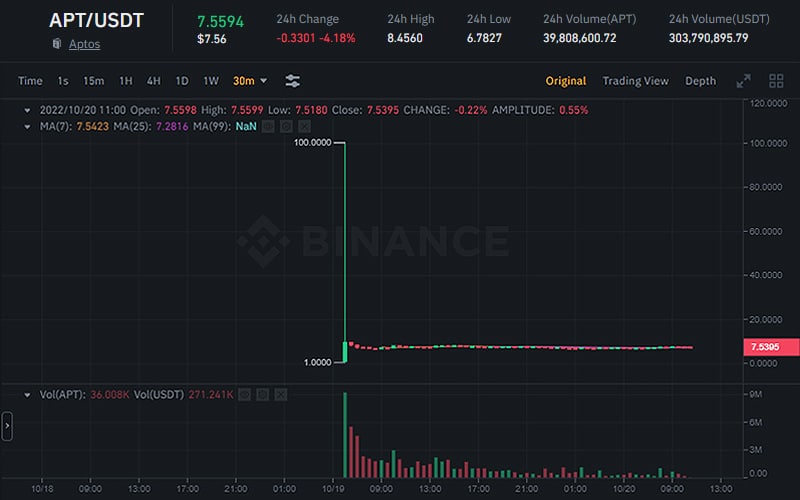

Twitter users came to just one conclusion about Aptos: it is a pump-and-dump token, as evidenced by its swift exchange listing and contradiction in its tokenomics.

Traders believe that as soon as they start buying the Aptos token(APT) and increase its value, Aptos team and VC’s will start dumping it in the open market. Taking a look at APT on Binance there concern doesn’t seem wrong.

Additionally, Aptos’ social media is of little to no use. According to rumors, Aptos is aware that something is off. The Aptos Discord was down between Genesis and 1:30 PM PT, meaning users couldn’t chat or make any queries.

Aptos blockchain currently has a lower tps than Bitcoin and a majority of tokens are either staked or feared to be dumped on retail investors.