In light of catastrophic events in the crypto industry, it became hard for traders and investors to trust the safety of their assets. As the crypto community called for transparency, the Proof of Reserves concept surfaced to ensure customer holdings are not misused.

The need for transparency became urgent when FTX, which “once” was the second-largest crypto exchange worth $32 billion, ended up triggering a liquidation cascade, taking down many crypto firms with it.

The list includes Alameda Research, Voyager Digital, Genesis, BlockFi, Celsius, and Three Arrows Capital. All these firms paused customer withdrawals or filed for bankruptcy, which shook the investors and traders to their core.

All these recent events prompted Binance CEO Changpeng Zhao to employ a Proof of Reserves audit to ensure complete transparency of asset management, making the concept popular in the industry.

Since people began questioning the reliability and integrity of crypto custodians after witnessing major collapses, proof of reserves became a way to instill trust in people about crypto and its underlying blockchain technology. Now, let’s understand how proof of reserves has swiftly gained widespread support.

What is Proof of Reserves?

Proof of Reserves (PoR) is a way to prove that crypto exchanges have enough assets to cover their liabilities. It allows users to verify that their funds are safe and not misused by the exchange. PoR increases trust and security in the crypto industry.

Simply put, proof of reserves refers to an independent audit conducted by a third party that seeks to confirm that a custodian holds the assets it claims to on behalf of its clients. As such, this auditor ensures that the entity being audited has sufficient reserves to support all of its depositor’s balances.

Considering the liquidity crunch the crypto industry faced in 2022, undergoing a proof-of-reserve audit became a critical step.

To provide trustworthy digital assets services, firms are incorporating PoR audits to ensure customers and the public that the custodian is sufficiently liquid and solvent. This way, the customers get proper transparency on the availability of their funds and the surety that they can withdraw funds anytime.

Now, to understand the mechanism of proof of reserves better, let’s take a deep dive into what exactly the proof of reserves audit is.

What is Proof of Reserves audit?

Proof of Reserves audit means that an exchange is partnering with a third-party crypto audit firm to confirm that it has assets on its balance sheet and balances the customer holdings. This is to ensure that customer holdings are not mismanaged or misused and there are real assets backing the cryptos held.

In this manner, these third-party reports are cryptographically reconciled ensuring security and privacy. A proof of reserves audit greatly benefits crypto firms acting as custodians to retain customers and enhance trust in their operations.

Furthermore, the PoR method prohibits exchanges from investing customers’ money in other companies or ventures, such that businesses are transparent about what they are doing with their depositors’ funds.

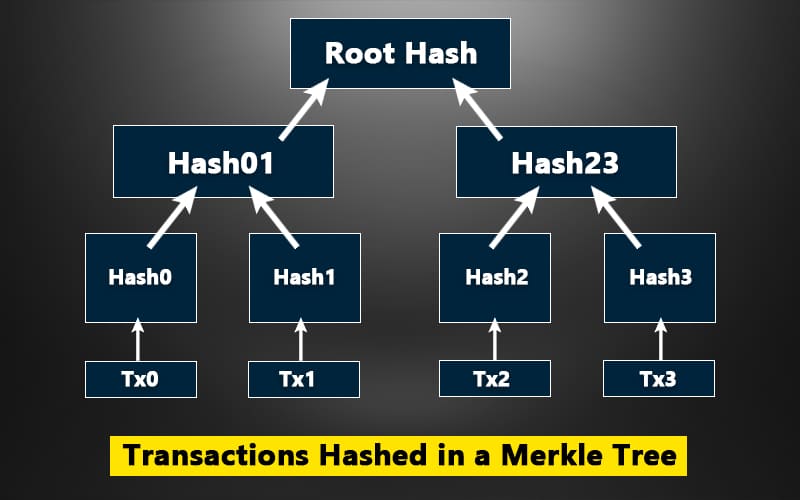

To conduct the entire process, the Proof of Reserves audit uses the technique of Merkle trees – a privacy-friendly data structure designed to encrypt blockchain data securely. Now, let’s understand how Proof of reserves audit works by leveraging the Merkle tree technique.

How does Proof of Reserves Work?

Proof of Reserves works on the Merkle tree technique that aggregates the total of all customer balances without exposing any private information.

This auditor takes an anonymized snapshot of all clients’ balances held and encapsulates them into a Merkel tree. Then, the auditor obtains a Merkle root which is a tamper-proof cryptographic fingerprint that uniquely identifies the combination of these balances at the time when the snapshot was taken.

Also, the Merkle root sums up the balances of all the accounts taken and then proceeds to verify it on public blockchains where assets are held using the digital signatures provided by the exchange.

After which the auditor uses the Merkle tree hashing mechanism that underpins blockchain technology which keeps that data protected from any hacks or tampering. The data of the balances and assets’ details on the blockchain are verified, ensuring consistency.

This proof of reserves audit method also sets up systems for customers to check if the assets they hold are verified. Any changes in data will reflect in Merkle root, indicating possible tampering with assets.

What are the Benefits of Proof of Reserves?

Proof of Reserves benefits investors and users alike, as it acts as a due diligence tool to acquire relevant data about their crypto holdings. Moreover, it appeals to regulators as a self-regulating approach that supports their broad crypto industry strategy.

When it comes to traditional financial institutions, the government bails them out in case of bankruptcy, unlike crypto institutions, which have no backing of that kind. On the other hand, the concept of “proof of reserves”’ serves as a foundation for crypto firms to focus on transparency and customer asset privacy.

Proof of reserves not only provides transparency but also information about the availability and backing of funds. This way, customers can easily cryptographically verify that their account balances are included in the said system. Proof of reserves eliminates questionable or illegal financial activities while also safeguarding customers against harmful players.

With the proof of reserves mechanism in place, customers start to trust custodians, leading to client retention. Recognizing the potential, ByBit has recently announced employing a Merkle Tree-verified proof of reserves audit to ensure complete transparency of asset management.

What is the Problem with Proof of Reserves?

Similar to any breakthrough technology that was ever incorporated in the digital era, proof of reserves also has some downsides. The critical issue with proof of reserves audit is that its accuracy depends upon the auditor’s competence. Also, audit results may be manipulated as they may be produced by a third-party auditor in collaboration with the custodian under consideration.

The correctness of verified balances is only valid during the time of audit which leaves room for exploiting facts. In case of loss of private keys or users’ funds, the legitimacy of the proof of reserves can be questioned. The major con of this system is that it cannot determine if the funds were borrowed to pass the audit.

Nevertheless, a crypto exchange can improve its PoR audits to build and maintain users’ trust by shortening the intervals between audits to ensure there are no suspicious financial activities between cycles.

As such, an exchange could also use a reputable third-party firm with no financial interest in it or its related bodies. Following this approach can ensure that PoR audits are accurate to the knowledge of all parties involved, including exchange and its customers.

Also Read: WazirX Proof-of-Reserves Report: 90% User Assets in Binance Wallet

Conclusion:

Though the proof of reserves method assures that a crypto exchange has the assets in place to cover its liabilities, many experts don’t think of it as a foolproof mechanism. The reason is, the method is only a single snapshot in time and not a live accounting of balances over time. Hence, it reflects only the on-chain assets of the custodian and is incapable to track where those assets come from.

However, it’s fair to say, proof-of-reserves is a necessary step for any crypto company since countries across the globe are aiming for stringent crypto regulators. The crypto firms that act as a custodian on behalf of their customers can leverage proof of reserves audit to benefit the customers and the crypto community as a whole.

While the proof of reserves comes with some flaws, it is still a good place to provide customers assurance and confidence in digital assets.