True to its volatile form, the crypto market has been in an acute downward trend for the past few weeks. Bitcoin (BTC) touched its all-time high of $68,000 in November 2021 but is currently trading below $20,000 resulting in a market-wide crypto crash.

Crypto entered bearish sentiment since November 2021, slowly declining with time. However, the market entered a phase of sharp decline triggered by the crash of Terra Luna’s stablecoin which led to millions being wiped out from the crypto market.

This algorithmic stablecoin crisis caused a domino effect on the rest of the crypto market due to massive liquidations and uncertainty that fuelled a crisis in crypto lending.

Major crypto firms such as Celsius, Three Arrows Capital and Voyager are all in troubled waters and on the brink of either bankruptcy or liquidation owing to the recent crypto crash.

Amid all this fear, uncertainty and doubt surrounding the crypto crash, it seems incredibly risky to trade or invest in the market. Even the people who already hold positions in the market might not know what to do seeing as to how the market is swinging to its own rhythm.

This article outlines techniques which can be used to trade during the current crypto crash by both novice and veteran investors.

What to do During the Crypto Crash?

The crypto market is notorious for its volatility, making it a high-risk, high-reward investment.

One of the strategies which can be employed during a crypto crash is the “HODL” strategy, which is an acronym for ‘Hold On for Dear Life’.

It is a term commonly used by crypto investors and refers to the act of refusing to sell even amid a bear market.

For people who are holding positions in the crypto market, believe that the market will bounce back (historically, it always has), and do not face liquidity issues, ‘HODL’ might prove to be the best strategy.

Mind you, it could be years before the market bounces back. If crypto history has taught us anything, it is that the bear market can turn into a dreaded crypto winter similar to that of 2018 or be short lived and bounce back in a few months.

For people who are already invested in the crypto market but do not have the liberty to employ the HODL strategy, written below are a few other strategies which they can use to earn back their money during the current crypto crash.

Best Techniques for Trading During a Crypto Crash

Even investors who do not hold positions in the market but believe a crypto crash is the time to trade, can employ the below mentioned strategies.

- SCALPING

Scalping is a short-term trading strategy that a trader adopts to make frequent small profits from small price movements each day. Small profits from each trade add up to generate a substantial amount over time.

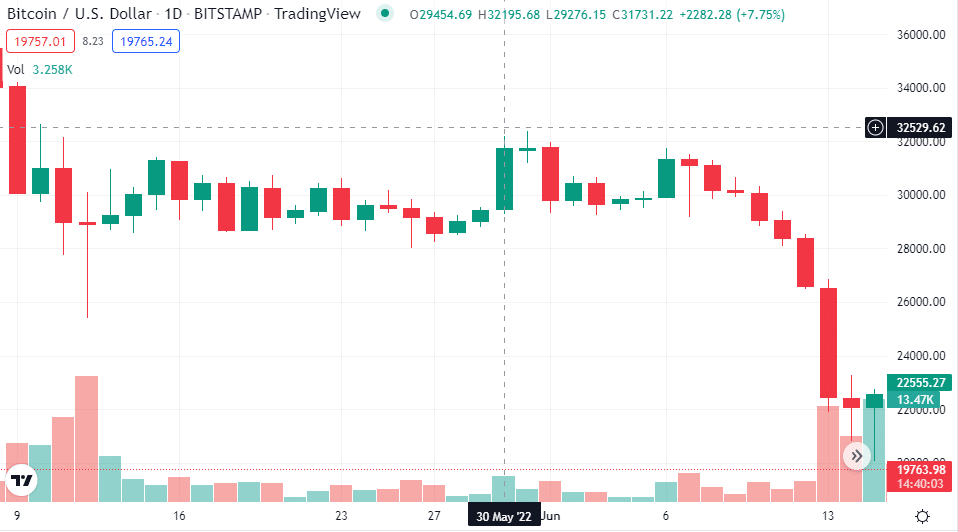

The crypto market, although volatile, fluctuates between a certain range for a time period. For example, from May 10 to June 11 the crypto pair BTC/USD traded only between $28,000 and $32,000.

A trader should, by rigorous analysis, figure out the range and try to achieve a mere 2% profit daily. Since bear markets are unpredictable, a strict stop loss of 1% should also be fixed.

Traders can go about the scalping technique in two ways:

- The first method is to minimize risk and invest the same amount of money everyday. Suppose a trader invests $100 everyday, books a profit of 2%, that is $2 and exits his position.

At the end of 50 successful trades, the trader has made $100 in profits and thus achieved a 100% return. It must be kept in mind that not every trade will result in a profit. Certain trades will also need to be closed at a loss.

The trader at the end of the day should have made a 2% profit overall, regardless of the number of trades.

- Another way to go about the scalping technique is to compound the amount everyday. Taking the same numbers as above, if a trader invests $100 the first day, and books a 2% profit, then he has $102 at the end of the day.

Instead of keeping aside the $2 profit, the trader invests the complete $102 in the market the next day and makes a 2% profit on it. This would result in a profit of $2.04 the next day. At the end of the day, the trader would have $104.04.

Continuing the pattern, a trader would have $181.13 at the end of 30 days and $269.15 at the end of 50 days.

(The above mentioned figures do not include the fees imposed by the trading platforms. Each platform imposes different trading fees and traders must include those fees in their calculations.)

This method, although risky, results in a higher profit margin. A trader practicing the scalping technique needs consistency, velocity and chart reading skills. Scalpers need to be able to identify short-term support and resistance levels through technical analysis.

Traders can use indicators such as the Moving Averages and Relative Strength Index. They also need an in-depth understanding of the movement pattern of the candlesticks in the graph.

Traders practicing this method must always remember to follow their plan and not give into their greed to book bigger profits.

Although a tempting option, this technique can lead to massive losses during a crypto crash and traders must rigorously follow their bottom line and book their losses at their stop loss.

- DOLLAR-COST AVERAGING

Another method to trade safely during this crypto crash is the Dollar-Cost Averaging (DCA) technique. This method, however, cannot be used to make money instantly.

Dollar-Cost Averaging is an investment strategy wherein an investor divides the total amount to be invested across periodic purchases of the asset with an effort to reduce the impact of volatility on the overall purchase.

In simpler words, an investor divides his total amount into smaller amounts and invests them regularly regardless of the market condition.

This leads to the investor buying shares at a very low price point and decreasing their average cost.

Suppose an investor has $1200. Instead of investing it all in one trade, the DCA strategy proposes investing $100 each month. If someone has access to more capital, then they can invest higher amounts or invest with more frequency.

This gives the investor a better chance of buying an asset at a lower price, ultimately generating higher profits.

However, investors should remember that this strategy cannot be used to make quick returns. The investor needs to wait for the market to bounce back from the current crypto crash to generate substantial profits.

- WASH-SALE LOOPHOLE AND TAX LOSS HARVESTING

(This technique is not applicable to residents of all countries. It can only be applied in certain jurisdictions.)

This technique is not a direct way of earning money in a bear market, however it exploits a certain loophole in the regulations called the ‘wash sale’ loophole to provide long-term returns and increase tax efficiency of a financial plan.

To understand this technique let us first understand the ‘wash sale’ loophole. In traditional markets, when an investor sells an asset, he has to wait 30 days before he can repurchase it.

If the investor makes the repurchase before 30 days, the transaction is considered a “wash sale” and the loss cannot be used to offset a gain.

In the crypto markets however, this tax rule has not been applied yet. Meaning that an investor can repurchase an asset immediately after selling it and use the loss to offset future gains. There is no wait time required.

Suppose an investor purchased $10,000 worth of BTC when it was trading at around $45,000. This means he bought 0.22 BTC. Currently, BTC is trading at around $20,000, which values the 0.22 BTC at $4400. The investor has an unrealised loss of $5600.

In order to realize this loss, the investor can simply sell his crypto positions. Thus, his loss of $5600 can now be used to offset any taxable gains in other parts of the investor’s portfolio where he has profited. This is known as tax-loss harvesting.

An investor can therefore rack up losses as big as he likes and then use them in the future to offset his capital gain taxes.

Unlike traditional markets the investor also does not have to wait 30 days and can immediately repurchase BTC or the asset he was trading.

This technique thus allows an investor to preserve his position while at the same time realize his losses. This technique is one of the best ways to earn money by decreasing a person’s taxable gains and can be applied during the current crypto crash.

CONCLUSION

Trading is a complicated and risky task, especially during a crypto crash with no end in sight. The current crypto crash was both unforeseen and unexpected for many investors, leading to their capitals being tied up in positions.

In times like these investors should follow a predetermined plan, have patience and remain resilient.

The above suggested techniques should be applied by investors only after thorough research of their own accord. This article is in no manner or form financial advice and every person is suggested to do their due diligence before entering the crypto market.

Also Read: A Guide to do your own Research (DYOR) for Crypto Trading