Navigating the volatile cryptocurrency markets through technical analysis requires exploiting every potential edge. Understanding the various trading patterns that emerge can make all the difference for traders looking for a profit.

Various trading patterns like Ascending Triangles, Flag Formations, Cups and Handles, and Head and Shoulders have proven high probability predictive power for forecasting future price movements.

By identifying these chart and candlestick patterns early, crypto traders can make highly informed decisions to buy, sell, or hold digital assets.

Regardless of trading experience level, technical analysis leads to better capitalizing on high-probability trades. Mastering both recurring chart and candlestick patterns is an instrumental key to trading crypto profitably amidst sharp market swings.

Common Trading Patterns in Cryptocurrency

Trading patterns can be divided into several categories, each with its own unique characteristics and potential outcomes for traders. Understanding these trading patterns can provide a solid foundation for your trading strategies.

Let’s explore a few trading patterns that every crypto trader needs to know.

1. Bullish Flag Pattern

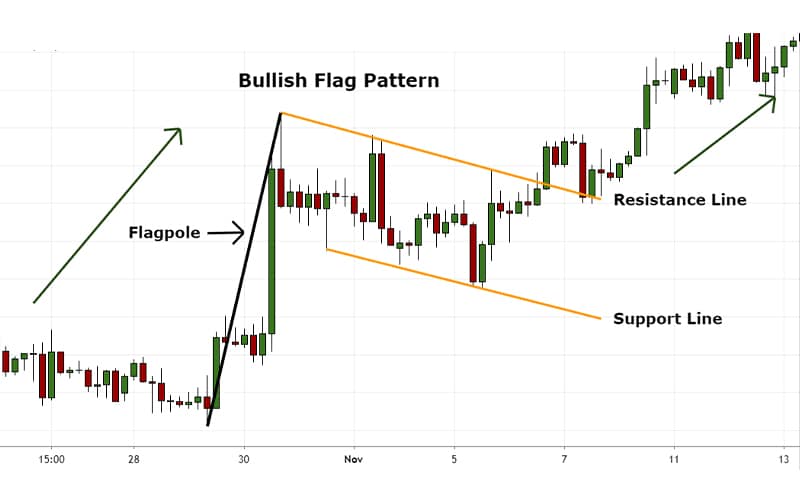

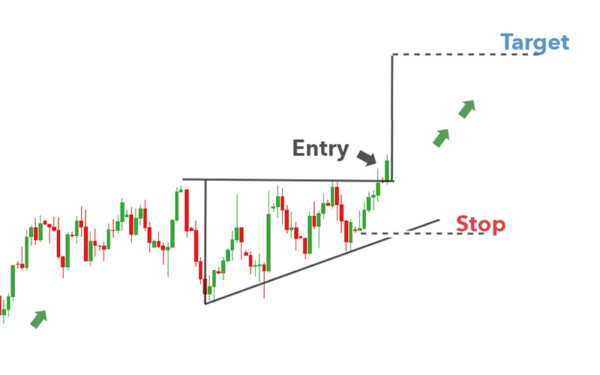

The bull flag pattern is a continuation pattern that usually occurs after a significant upward price movement. It is characterized by a flagpole, which represents the initial price surge, followed by a consolidation period in the form of a flag.

This pattern suggests that the price is likely to resume its upward trend after the consolidation phase. Traders often look for a breakout above the upper trendline of the flag as a signal to enter a long position.

The target for this pattern can typically be measured by extending the length of the flagpole from the breakout point.

2. Bearish Flag Pattern

The bear flag pattern is the opposite of the bull flag pattern and is considered a continuation pattern as well. It forms after a significant downward price movement, with a consolidation period resembling a flag.

The bear flag pattern suggests that the price is likely to continue its downward trend after the consolidation phase. To trade this pattern, traders typically wait for a breakout below the lower trendline of the flag as a signal to enter a short position.

The target can be calculated by extending the length of the flagpole from the breakout point.

3. Head & Shoulders Pattern

The head and shoulders pattern is a reversal pattern that signals the end of an uptrend. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders).

The pattern is completed when the price breaks below the neckline, which is a line connecting the lows between the shoulders. Traders often interpret this pattern as a signal to enter a short position, as it suggests that the price is likely to reverse and move lower.

The target for these patterns could be the next key level or support level.

4. Double Top Pattern

The double-top pattern is also a reversal pattern that indicates a potential trend reversal. The double top pattern forms when the price reaches a high, retreats, and then revisits the same high before declining.

Traders often wait for a breakout below the neckline in the double-top pattern to confirm the reversal.

The target for these patterns is usually measured based on the traders’ preference. It could be the next key level or support level

5. Double Bottom Pattern

The double-bottom pattern is the opposite of the double-top pattern. It forms when the price reaches a low, bounces, and then revisits the same low before rising.

Traders often wait for a breakout above the neckline also known as the resistance line in the double bottom pattern to confirm the reversal.

6. Ascending Triangle Pattern

The ascending triangle pattern is a continuation pattern that forms when the price creates higher lows and meets a horizontal resistance level.

This pattern suggests that the price is likely to break out above the resistance level and continue its upward trend. Traders often look for a breakout above the upper trendline in the ascending triangle pattern to enter a position.

7. Descending Triangle Pattern

The Descending triangle pattern is the opposite of the ascending triangle pattern. It is also a continuation pattern that forms when the price creates lower highs and meets a horizontal support level.

This pattern suggests that the price is likely to break out below the support level and continue its downward trend. Traders often look for a breakout below the lower trendline in the descending triangle pattern to enter a position.

The target for these patterns is usually measured based on the traders’ preference. It could be the next key level or support level.

8. Symmetrical Triangle Pattern

The Symmetrical Triangle pattern is a neutral chart formation that shows a period of consolidation before a major price movement. It is created by two converging trend lines that connect a series of sequential peaks and troughs.

This pattern reflects a balance between buyers and sellers as the price bounces between support and resistance levels. The eventual breakout from the triangle provides trading signals – an upside breakout is bullish while a downside breakout is bearish.

9. Cup & Handle Pattern

The cup and handle pattern is a bullish continuation pattern that resembles a cup with a handle. It forms after a significant upward price movement followed by a consolidation period.

The handle is a smaller consolidation pattern that represents a temporary pause before the price resumes its upward trend. Traders often wait for a breakout above the resistance level of the handle to enter a long position.

10. Inverse Cup & Handle

The Inverse Cup and Handle is the opposite of the traditional cup and handle pattern. This pattern signals a potential bearish reversal of a price movement.

It is formed after a sustained uptrend, creating a “cup” shape as the price declines, consolidates, and then declines further in an arcing trajectory.

This culminates in a lower low that forms the cup “handle” before the price resumes its prior uptrend. If the price then breaches below the “handle” support level, it triggers the bearish signal of a downside breakout from the pattern.

Conclusion

As we have seen, there are numerous chart patterns to assist crypto traders in identifying opportunities and making informed decisions. By understanding patterns like the Head and Shoulders, Cup and Handle, Triangle, Flag, and Wedge, traders can aim to predict potential price movements.

Keeping aware of these trading patterns as well as support and resistance levels can help traders spot both continuations and reversals in the often volatile crypto markets.

Although past performance does not guarantee future results, these patterns have historically occurred consistently enough to be useful indicators when used along with other analysis techniques.

Continuing to learn to recognize trading patterns will help crypto traders maximize profits and minimize losses as they navigate the marketplace.