Imagine a world where you can own a piece of a luxury penthouse in New York City while sipping your morning tea in Delhi—all thanks to blockchain and the magic of tokenization. With the aim of democratizing finance and ownership, the rules of wealth creation are being rewritten as tangible (and intangible) assets go digital.

A recent expert panel in Dubai included a wide array of CEOs of leading law, blockchain, and venture capital firms. Experts discussed a topic that turned into a nearly hour-long discussion, stemming from the concept of tokenization of real-world assets (RWAs).

It was noted that immediately tokenizing as little as 5% of the world’s assets today would potentially yield trillions. By 2030, which is less than a decade away, the industry is projected to be worth $16.1 trillion.

This article dives deep into the world of tokenization, its profound potential, the intricate technicalities behind it, and the thrilling future it holds for real-world assets.

1. The Essence of Tokenization

Tokenization is nothing but a digital representation of rights on the blockchain of an underlying asset. Hence, these tokens represent fractional ownership in the underlying assets and can be freely traded and exchanged on various digital platforms. Real-world assets eligible for tokenization encompass a diverse spectrum:

- Real Estate: A plethora of real estate assets, from residential homes and commercial buildings to prime land plots, can be tokenized.

- Artistic Treasures: Fine art pieces, rare collectibles, and antique artifacts can all be represented in the digital realm.

- Equity: Privately held company shares and investments in burgeoning startups can be tokenized for broader accessibility.

- Commodity: Assets like precious metals, agricultural produce, and energy resources can also find their digital avatars.

- Debt Instruments: Bonds, loans, and promissory notes can be securely digitized, making financial transactions more efficient.

- Intellectual Property: Patents, copyrights, and trademarks, which have been confined to paper, can now transition to blockchain tokens.

- Infrastructure Innovation: Ambitious infrastructure projects, such as bridges, toll roads, and renewable energy installations, can harness tokenization for funding and investment.

How It Works: The Game Decomposed

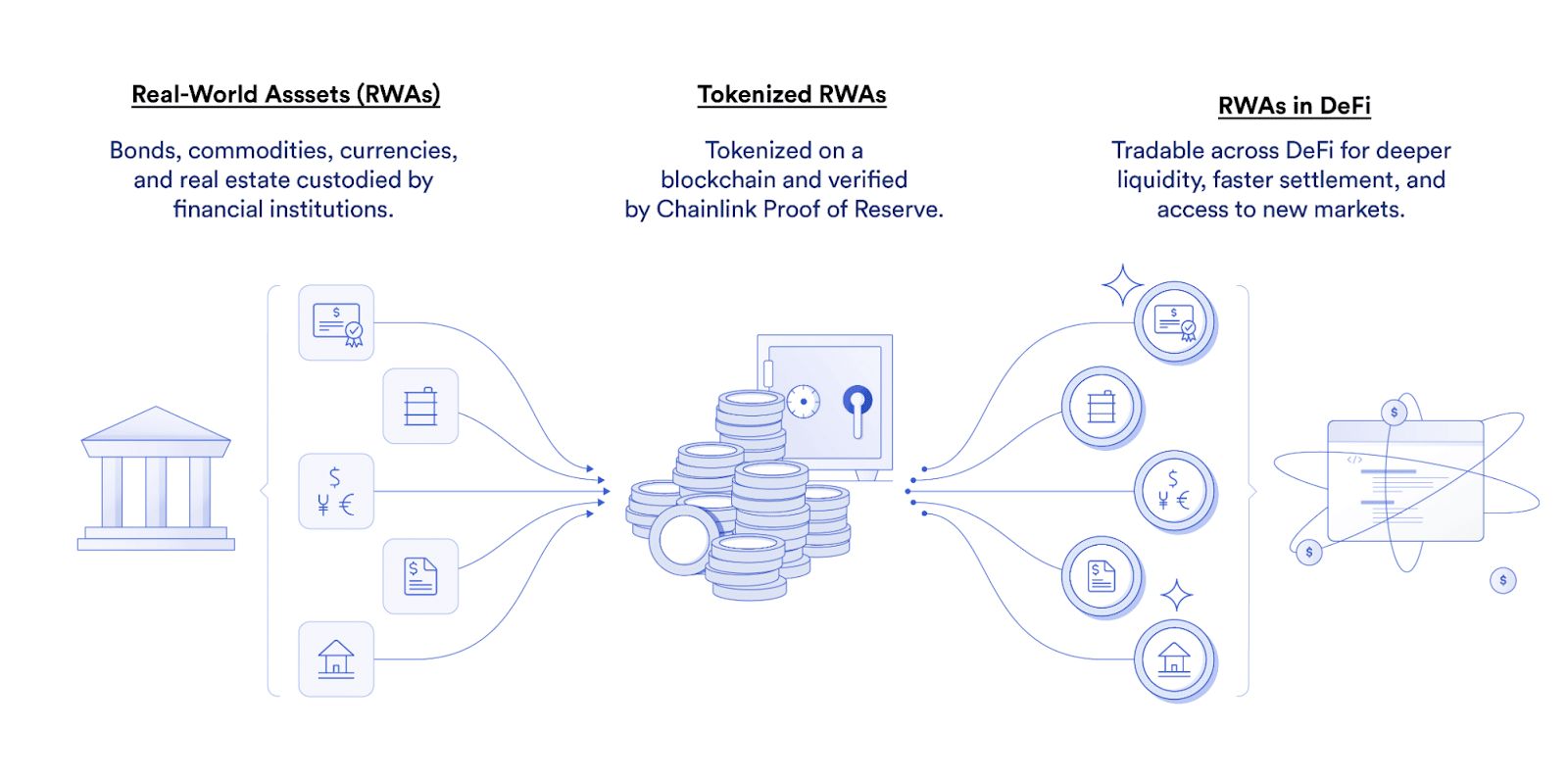

Source: ChainLink

The Problem

- Tangible assets mean physical items like real estate, machinery, cash, vehicles, and computers, while intangible assets include items such as logos, trademarks, goodwill, and patents. Both of these categories are tokenized. To illustrate how this process works, let’s take the example of real estate.

- Currently, when you want to purchase a home, you must secure the funds for the property, make an offer, and then endure a lengthy, often months-long, traditional transaction process. This cumbersome procedure poses a significant barrier, preventing billions of people without substantial capital from participating in real estate investments.

- Moreover, these transactions are notoriously sluggish and illiquid, making it impossible to sell a property instantaneously. Our current system also lacks mechanisms for shorting or betting on the depreciation of property values.

The Solution

- Imagine a group of investors acquiring an apartment building for $10,000,000. After covering property taxes, maintenance expenses, and fees, the building yields a monthly profit of $60,000.

- To modernize ownership, these investors employ a smart contract and migrate the property’s digital representation onto a blockchain platform like Ethereum.

- Subsequently, they create tokens that can be freely sold and exchanged on peer-to-peer marketplaces. In this scenario, let’s assume they issue 10,000,000 tokens, equating to a value of $1 per token.

- Whenever tenants pay their rent, the smart contract automatically disburses a portion of the rent to token holders. For instance, an individual who owns 1000 tokens for this property would receive a monthly income of $6.

- Additionally, they would witness fluctuations in the token’s value in tandem with the real estate market’s current trends. So, the token appreciates or depreciates similarly to TradFi.

- At any given moment, they retain the option to sell their tokens, guaranteeing an instantaneous transfer of ownership.

- This fractional ownership model promotes financial inclusivity, enabling individuals who couldn’t afford an entire building to become partial investors.

2. The Allure of Tokenization

Bank of America has identified RWA tokenization as a significant factor influencing the adoption of digital assets. According to their findings, the market for tokenized gold has attracted investments exceeding $1 billion.

Additionally, there’s a rising interest in tokenized U.S. Treasury bonds, with the total market capitalization of tokenized money market funds approaching $500 million, as per CoinDesk’s data.

- Enhanced Liquidity: Traditional assets like real estate and art are often deemed illiquid, requiring substantial time and effort for resale. Tokenization allows assets to be divided into tradable fractions, democratizing liquidity, and hastening transactions.

- Democratization of Ownership: Tokenization facilitates fractional ownership, enabling investors to hold minuscule fractions of high-value assets. This democratization breaks down barriers, granting wider access to premium assets.

- Cost-Efficiency Revolution: Traditional financial transactions entail substantial fees, intermediaries, and administrative overheads. Tokenization slashes these costs by introducing efficiency and cost-effectiveness to the process.

- The Shield of Transparency and Security: Blockchain’s inherent transparency and security features serve as a safeguard against fraud, fostering trust through an immutable ledger of transactions.

- Global Access: Tokenized assets are accessible globally, around the clock, breaking free from geographical limitations and opening new horizons for investors worldwide.

- Automated Compliance Sentinel: Smart contracts, the backbone of tokenization, can enforce regulatory compliance seamlessly, ensuring that only eligible investors engage in trading. This automation streamlines compliance efforts and minimizes regulatory infractions.

3. Challenges and Complexities

As with all breakthroughs, especially in tech, the path to the realization of tokenization’s potential is not without its share of hurdles and complexities.

If you want an in-depth take on tokenization and its challenges, explore this report by JSTOR. For now, let’s briefly discuss how these challenges are affecting the greater adoption of tokenization.

- Regulatory Labyrinth: The regulatory landscape surrounding tokenized assets remains in flux. Varied jurisdictions introduce different rules, demanding intricate navigation by issuers and investors alike.

- Security Vigilance: Although blockchain technology is renowned for its security, it is not impervious to breaches. Ensuring the robust security of tokenized assets and their supporting platforms remains paramount.

- Fragmented Markets: Tokenization’s meteoric rise has spawned numerous platforms and standards. The ensuing market fragmentation can bewilder investors, necessitating a careful selection of platforms.

- Lack of Universal Standards: The absence of universally accepted practices and protocols in the tokenization sphere can generate confusion and inefficiencies. Establishing common standards is vital for tokenized assets to gain widespread adoption.

- Educational Pioneering: Many investors and asset owners are still in the dark about tokenization’s capabilities. Spreading awareness and educating the market are equally essential components of its success.

4. Real-World Triumphs

The real-world impact of tokenizing assets is evident in several striking examples.

1. Ondo Finance

Ondo Finance is a pioneering decentralized finance (DeFi) platform that revolutionizes yield farming. It tokenizes USD to create its financial product, one of its native tokens, USDY. After signing up, you can start investing by connecting your wallet and depositing stablecoins, or, in some cases, wiring USD. When you want to cash out and get stablecoins or USD in return, simply request a redemption.

Note that USDY is not classified as a traditional stablecoin; instead, it is a tokenized secured note.

Users deposit assets into liquidity pools, and Ondo’s algorithms automatically allocate these funds to various DeFi protocols, ensuring optimal returns.

2. Backed Finance

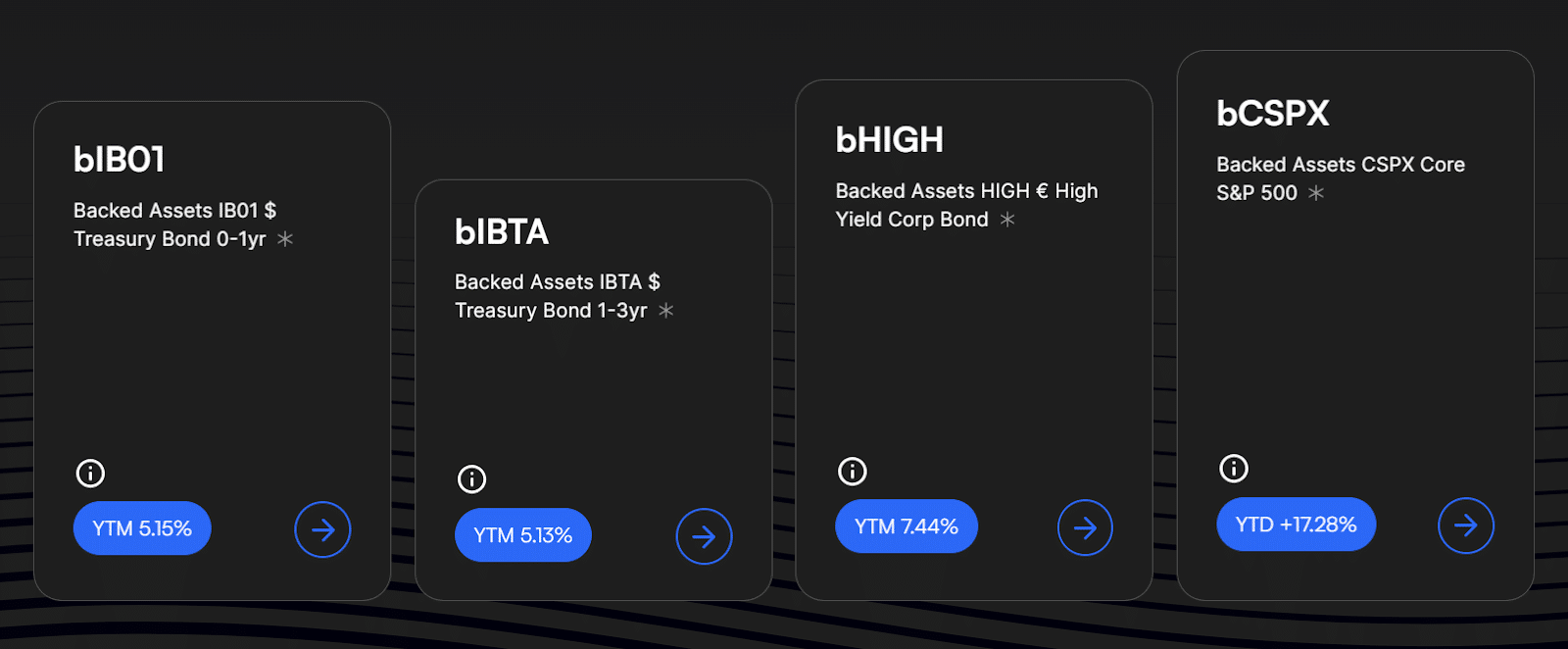

- Backed Finance is another promising DeFi project. Each native token is a unit of a fully collateralized tracker certificate, which tracks the listed value of a specific traded security (the underlying) and is fully backed by that security.

- Backed Finance significantly lowers the existing barrier to investing in publicly traded securities as it offers a direct equivalent underlying security. Their basket of securities includes Treasury bonds and equity.

These tokens are issued only to professional investors, and everyone else can open a redemption account. The company guarantees these backings through a proof-of-reserves mechanism.

3. Maple Finance

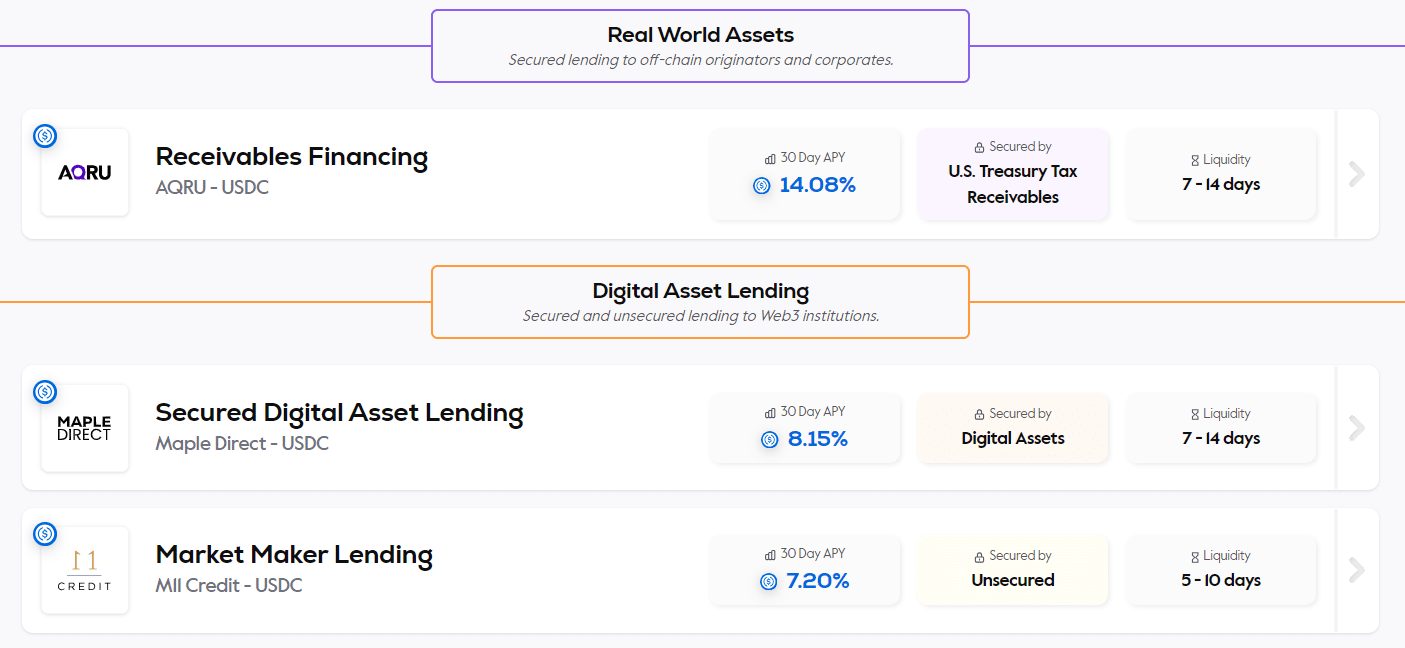

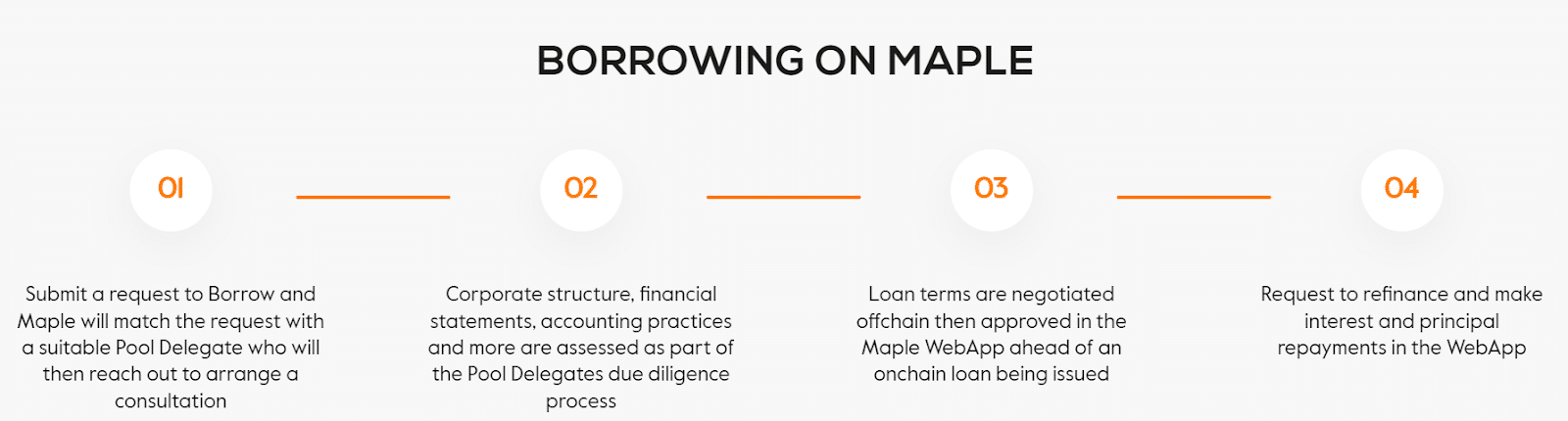

- Maple Finance, an Ethereum-based DeFi protocol, enables fixed-term, fixed-rate lending. It employs liquidity pools, where lenders provide assets for lending and borrowers can secure loans at predefined interest rates.

- This protocol adds a layer of predictability and risk management to DeFi lending, attracting users seeking stable-yield opportunities. The lenders include institutional investors such as corporate treasuries, high-net-worth individuals (HNWIs), and crypto funds. They tokenize USDT to lend to RWAs and digital assets like Web3 platforms.

Similarly, Maple makes for a bilateral platform that gives borrowers space to buy into these pools to finance their ventures.

Conclusion:

The tokenization of real-world assets represents a seismic shift in financial paradigms, promising not only increased liquidity and democratized ownership but also the potential to rewrite the future of finance itself. For instance, the global payment networks Swift and Chainlink recently carried out a string of experiments on tokenized asset transfers, marking a significant step forward in the development of asset tokenization markets.

Yet, while the promise is immense, addressing challenges like regulatory ambiguity and security vulnerabilities is essential for tokenization to achieve its full potential.

The financial future is being redefined through tokenization, and its transformative power will reverberate far and wide, shaping a new era of investment and wealth creation.