While Ethereum has laid the tracks for DeFi trains, Radix DLT is here to become the new Ethereum, promising high-speed express to the next generation of DeFi. Radix DLT strives to become a new base layer specifically to ensure safe and scalable finance with decentralised attributes.

The Inclusiveness of Radix offers a range of DeFi solutions to onboard a range of financial products currently unavailable in the DeFi landscape. At the same time, it filters out numerous loopholes in the existing blockchain network to safeguard it against exploitations and hacks.

Meanwhile, similar to other DLT networks, Radix too records transactions of digital currency or cryptocurrency. Additionally, in exchange for cryptocurrency payments, it serves as a venue for software developers and programmers to contribute to the development of rules for how blockchain-based services function.

Take a seat and learn more about Radix, what it is, how it works, and why you might use it, in the following paragraph.

What is Radix DLT?

Radix is a layer-1 decentralized finance with the full stack solution with excellent capacity. Because financial products and services like loans and money transfers are essential for the survival of decentralized financial systems. Developers use Radic to construct decentralized money protocols.

Protocols are “rules” built with developer-written programming in a “smart contract.” The application runs by itself, and when the rules are deployed, nobody may alter them to maintain decentralization. You can trade, lend money, invest, etc. on sites like Radix and Ethereum.

Created in 2017, by Dan Hughes, Radix has a native token, XRD, whose holders can take part in the proof-of-state validation method and profit from it.

In 2023, the mainnet of the Radix open-source network is scheduled to go live, making the future of the DeFi ecosystem a reality.

To showcase its potential, the business is currently developing over 100 dApps on Radix while it is still in preparation.

How Does Radix DLT Work?

Radix represents just one of the various ecosystems that allow thousands of assets to work together effectively.

It contains several qualities that make it possible for both it and its creators to operate quickly, safely, and easily.

Also, the ability to scale, privacy, and developer experience are the three main problems Radix was created to address. Its technical design provides an ideal framework for dependable applications using DeFi.

The Cerberus Mechanism

Radix’s innovative Cerberus consensus mechanism, which permits linear scaling with ensured safety, forms the basis of the system.

Cerberus employs a novel combination of Byzantine failure tolerance and a DAG-based ledger framework, in contrast to proof-of-work and proof-of-stake methods.

Due to the simultaneous execution of verification between node groups made possible by this, the speed of transactions for the consensus process is greatly increased. Each node group agrees, and the DAG ledger is used to remotely manage the groups’ ledger updates.

Furthermore, Radix follows a “composiblity” mechanism that allows multiple dApps to freely and frictionlessly combine. This makes it possible for a DeFi service to incorporate various sources of the same data stream and execute smart contracts instantly, ultimately increasing network speed.

The Radix Engine

Similar to EVM (Ethereum Virtual Machine), The Radix Engine is the computer logic on the Radix network that allows developers to build and run decentralised application. Also, a component-based development framework for DeFi is available from Radix.

The Radix Engine takes different approach for the creation and issuance of the tokens for the dApps and protocols. In Radix Engine, tokens are not issued in smart contracts, instead, it is created by directly requesting them from the platform with some indispensable parameters.

Furthermore, The second version of Radix Engine, called Radix Engine v2, is going to make it much easier for developers to create what are known as “smart contracts” on the Radix Engine platform. These smart contracts will be able to handle financial assets and decentralized applications (dApps) using a unique approach that Radix Engine uses, which is based on assets and a system called FSM (Finite State Machine).

To make it even simpler for developers, Radix Engine has its own programming language called Scrypto. Scrypto makes it quick and easy to build a wide range of DeFi (Decentralized Finance) applications, assets, and features, all while reducing the risks and complications that developers often face when working with typical smart contract development tools today.

The platform uses a straightforward and safe structure, developers may create dApps using the asset-oriented crypto coding language.

Thus, anything that exists in a Radix system is an outstanding citizen, including identities, tokens, NFTs, and data.

Using well-known abstract ideas, this concept makes it easier to code DeFi components like transactions, exchanges, and liquidity reservoirs.

Is Radix Safe to Use?

Since applications like UniSwap are outpacing the trade quantities of platforms like Coinbase, you should focus more on DeFi in general.

You should give Radix careful attention in addition to any other DLT since it has remedies for numerous issues that arise during the construction of blockchain Dapps, namely speed, capacity, and security.

Developers may now execute contracts swiftly and efficiently thanks to Radix, without running the risk of making rushed mistakes, introducing defects, or failing to meet demand. These issues are solved by Radix.

Additionally, Redix is the sole technology that, for developers, enables speedy building and programming, smooth scalability using Cerberus, and compensates you for improving it.

Radix is infinitely scalable without sacrificing its modularity. It was created to provide for the $400 trillion global financial system that exists. Congestion (bottlenecking) never occurs.

When discussing investment in XRD, it is advisable to use a trading platform like https://nerdynator.com/ for a smooth and secure trading experience.

What are XRD Tokens?

The platform contains a built-in currency called XRD that is used to cover transaction costs. Keep in mind that node runners receive these fees.

For the issuance of tokens, communication, and any other operation that modifies the ledger state, a fee for transactions is assessed. Upon operation confirmation, the charge is burned.

Each XRD holder has a “delegated proof-of-stake.” It’s a token that anyone with it can use to take an active role in Radix’s proof-of-stake consensus system, which was covered in the section before this one.

XRD tokens and EXRD tokens are not the same thing. EXRD serves as a stand-in replacement for the Ethereum ERC20 token that will eventually be converted into the Mainnnet XRD coin.

Additionally, developers who make improvements to Radix’s protocols are paid with the XRD token. This is advantageous because Radix’s network only accepts the XRD token as payment for transactional fees.

Additionally, the system’s tokens include a 365-day regulated activation function. The total quantity of XRD owned by the Radix Foundation declines as more is released into the public domain.

To protect its XRD tokens from inflation, Radix set a limit. Only 24 billion XRD tokens are now in circulation, and not all of them are accessible to developers and members.

Only slightly over 10% has been given to Radix’s charitable organization, the Radix Foundation, while the remaining 10% is kept by Radix itself to safeguard its future growth.

Be unbothered with the cap. The good thing for users is the fact that 50% of the total 24 billion cap is set aside exclusively for incentives for staking emissions. There are 24 billion tokens in existence, and 300 million of them are used annually.

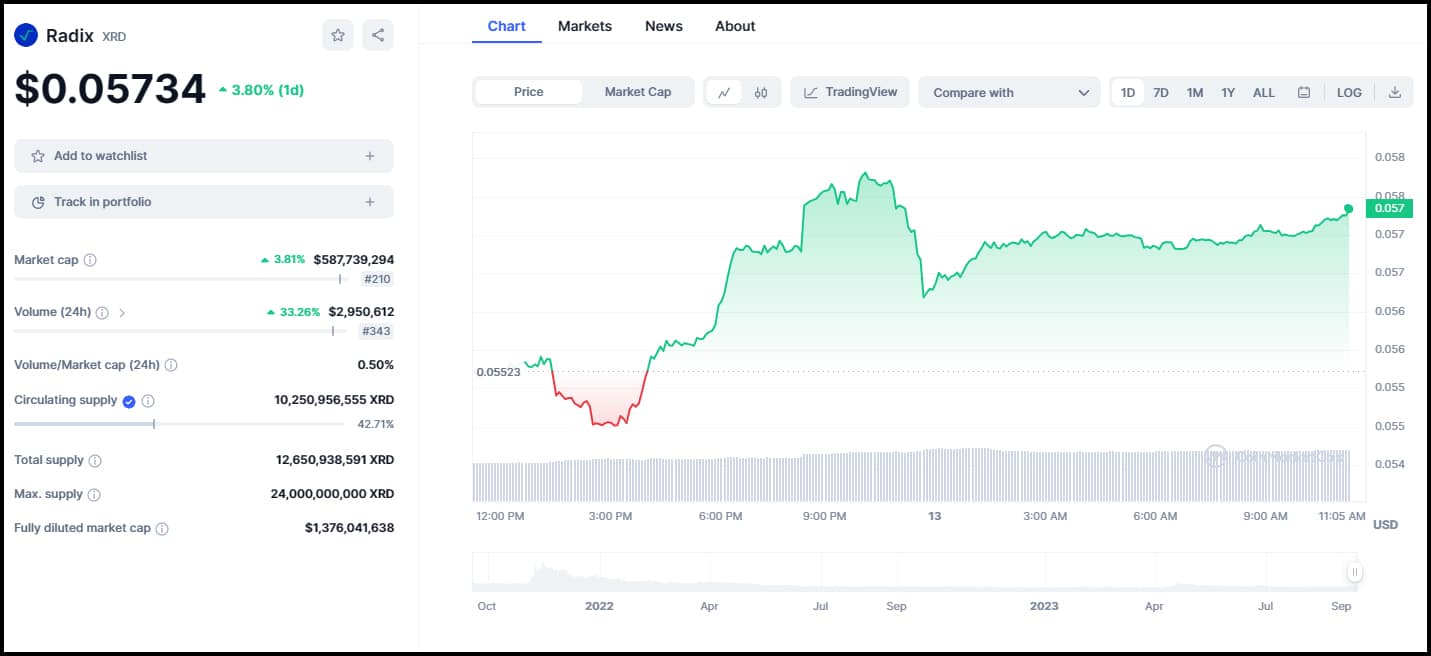

Radix DLT Price Prediction

According to the CoinmarkeCap, Radix (XRD) price movement has seen consolidation after its peak of $0.14 in April, making it no profit or loss investment. However, its price could soar in the upcoming time thanks to new developments and projects taking shape on it.

Is Radix (XRD) a Good Investment?

Even though blockchain technology has been gaining a lot of attention, real activity throughout the various protocols associated with it continues to be very low.

They are beginning to feel the pressure, though, since platforms such as Bitcoin and Ethereum routinely experience excessive fees and slow processing times for transactions.

Although blockchain is an impressive development, deleting the records stored in the system represents the obvious answer to the scale problem, regardless of how unpleasant that may be for you to hear.

This is what Radix intends to accomplish.

Also Read: Top 3 Decentralized Exchanges on Solana For 2024: How To Use Them?

What is the future of Radix DLT?

If Radix dlt can realize its ambitious aim, its mainnet launch, which is planned for 2023, would have a significant impact on the prospects of decentralized finance.

The Radix DLT roadmap shows an innovative technological stack designed specifically for DeFi, Radix has built amazing foundations. However, relying solely on technology is insufficient; the success of an ecosystem approach will determine how widely it is adopted.

On the development front, Radix wants to add more DeFi building blocks, connectivity tools, and developer materials to its component catalog. To draw builders, functionality and documentation must be improved.

Along with developers, Radix must promote user acceptance. Utilizing interfaces with cryptocurrency trading platforms and on-ramps can aid in bringing customers into the DeFi ecosystem. Additionally, Radix intends to go after legal compliance to gain access to major banks.

Despite increased usage, RADIX token worth and stability are likely to rise as interest in stakes and ownership rights rise. This can start a positive feedback loop that draws in additional consumers and experts.

If all goes according to plan, Radix’s outstanding innovation might let it establish its position as the best DeFi hub in the next five years.

However, there is a great rivalry as alternative platforms like Polkadot, Cosmos, and Polygon compete for DeFi supremacy. However, the future of DeFi, fueled by scalable, secure, and user-friendly technologies like Radix, is promising.

Conclusion

There is no denying how slow and ineffective the global banking system is.

For this reason, Radix DLT has developed an online database that records every transaction involving decentralized assets and has made it simple for software engineers and programmers to contribute to the development of rules for how blockchain-based services function in return for Bitcoin payments.

Radix stands a chance to surpass competing layer 1s and become the top DeFi hub if the mainnet lives up to its promises. Radix is going to establish itself as an authority with robust ecosystem expansion and immaculate execution, though.

In any case, the initiative demonstrates tremendous inventive potential to influence the development of a future open, owned, and easily accessible international monetary system.