Bitcoin, the world’s first decentralized cryptocurrency, is performing best since the TerraUSD (UST) de-peg, with the price correcting below $30,000. Intriguingly, an on-chain data analysis depicted a distinct behavioral change in Bitcoin accumulation trends–specifically among long-term Bitcoin holders.

We are all aware that Bitcoin is unlike any other macro asset we have encountered. Following the industry-wide sell-off, it entered a period of consolidation at around $30,600. Despite some long-term holders (LTH) selling, the total supply held by these wallets recently returned to an all-time high (ATH) of 13.048 million BTC.

So according to a Glassnode report, the current market activity/buying spree is primarily driven by Bitcoin Hodlers, who are now “the only ones left” and appear to be “doubling down as prices correct below $30K”.

Observations On Bitcoin’s Accumulation Trends

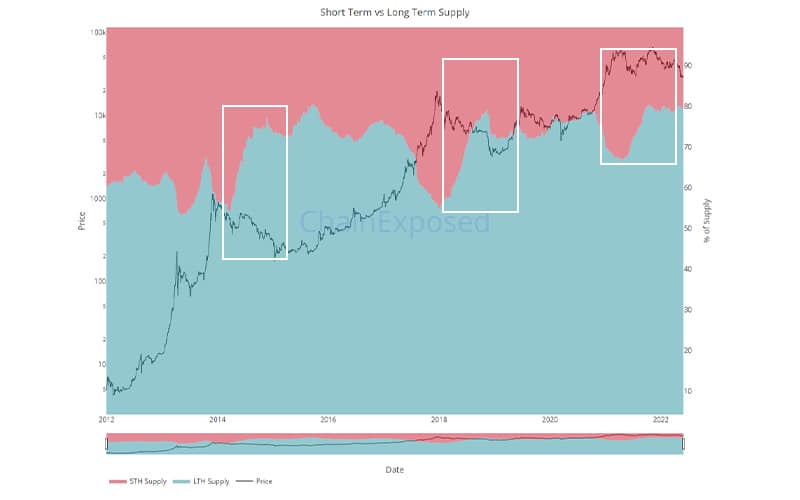

Based on coin movements and a 155-day holding period, on-chain user groups are divided into Long-Term Holders (LTH) and Short-Term Holders (STH). In other words, coins older than 155 days are statistically more likely to be re-spent in response to market volatility by newer market entrants, active traders, and “weak hands”.

- Long-term Bitcoin holders appear to be the largest group of Bitcoin investors

Now, these so-called Bitcoin long-term holders are divided into two groups: those with 100 BTC and those with over 10,000 BTC.

As a result, the aggregate Bitcoin balance of entities holding less than 100 BTC climbed by 80,724 BTC, which was “remarkably similar to the net 80,081 BTC liquidated by the Luna Foundation Guard.”

Clearly, the HODLer class dominates the network’s transaction activity.

We know that, as the LUNA saga progressed, the coins acquired by LFG were spent on-chain at significantly lower prices than when they were purchased.

The story, however, does not end here. Whales with more than 10,000 BTC in their wallet make up the other category. These entities now have 46,269 BTC in their account, which includes an 80k BTC from the LFG wallet.

We’re keeping an eye on long-term investors because they’re usually good at predicting when bitcoin will reach its bottom or lowest price. They aren’t very excellent at identifying the peak or bottom of a bear market, but they are rather good at predicting whether we’re getting near.

For example, in this chart, blue represents long-term holders’ supply and pink denotes short-term holders’ supply.

When all long-term holders reach a maximum holding of the total supply of bitcoin, that bitcoin becomes liquid, and there is no bitcoin left to be panic sold, and we begin to experience bottom levels.

Long-term investors aren’t great at hammering in the bottom, but they can tell when we’re getting close. In this chart, we can observe that the bottom levels from October to November 2014 were around $361 to $347, immediately before the final capitulation in January 2015, when one bitcoin was $175.6376.

These LTH held all of the bitcoin from the onset of the bull market in 2016 until July 2017 at a bitcoin price of roughly $2829. Following that, the LTH began distributing and selling those bitcoins to short-term holders. Of course, they realized significant profits because of this.

This happened in much the same way during the 2018 bear market, and they are now at the same levels as before, as seen in 2022, taking a large portion of the supply.

Glassnode suggests that unless significant coin redistribution occurs, we can expect this supply metric to rise over the next 3-4 months, implying that HODLers will continue to gradually soak up and hold on to the supply.

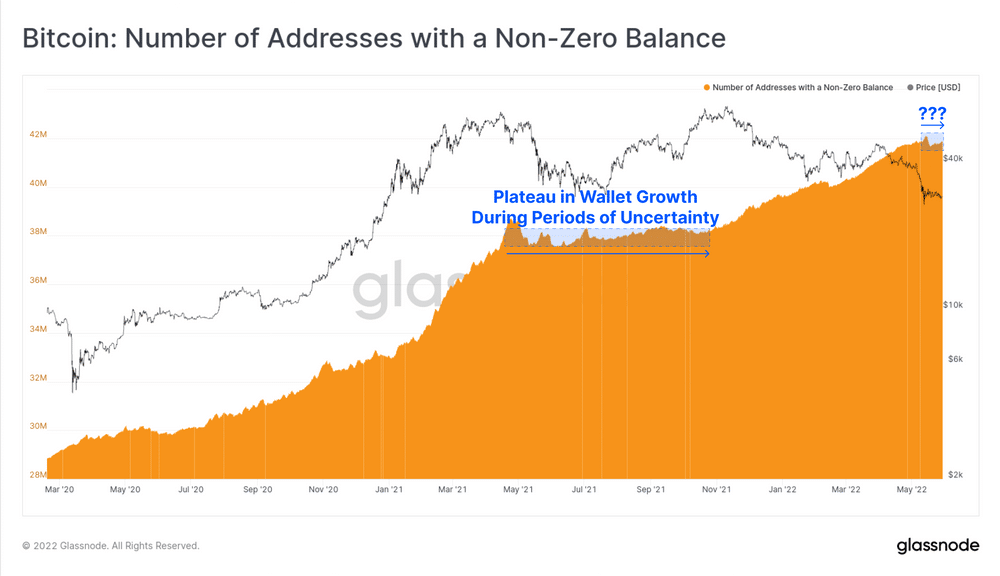

- Long plateau (period of stagnation) in wallet growth, indicating a lack of new bitcoin buyers with non-zero balances

Most wallet groups, “from shrimp to whales”, have slowed their on-chain accumulation trends, according to another Glassnode report. The truth was that it was related to the wallet cohorts between entities with balances of < 100 BTC and those with > 10k BTC.

During the massive sell-off following the Terra (LUNA) controversy, investors sucked dry their bitcoin holdings. Investors were anxious, and this sentiment persisted for four months, putting wallet growth on hold for the time being.

Essentially, the recent sell-off and lower prices have not yet inspired an influx of new users to the space, leaving only the HODLers. Similar to the previous observation, long-term investors see it as an opportunity to accumulate.

These wallet cohorts with 100-10k BTC have maintained a more neutral Accumulation Trend Score (an indicator that reflects the relative size of entities that are actively accumulating/distributing coins on-chain in terms of their BTC holdings) of around 0.5, indicating that their holdings have changed relatively little.

Summarizing

- We can see that the gradient of long-term holders’ aggregate wallet holdings increased after the recent sell-off.

- Despite continued price declines and a major spot liquidation event of 80k+ BTC, long-term holders are unwilling to let go of their bitcoins.