Starting out in the crypto market is difficult, especially given the massive number of potential tokens whose prices can spike as quickly as they fall. However, keeping a closer eye on trending crypto tokens can be a lucrative endeavor. Here, we are talking about the Aptos token, which recently displayed excellent potential with its prices surging 500% in the past few weeks.

While 2022 was a bearish year for the crypto market due to disasters, collapses, and bankruptcies, 2023 began with the meteoric rise of the Aptos token. Well, the best thing that came out of last year was the revolutionary Ethereum Merge upgrade and top stories on businesses, brands, and biggies setting their foothold in the Web3 space.

Cutting its way through all the havoc and setting a historic price pump, Aptos emerged as the most-hyped blockchain project ever. Crypto players at large are opting to focus on Aptos since its token, $APT, has solid community backing and innovative use cases that provide the basis for rapid growth.

The optimism for Aptos is such that many are positioning this emerging layer-one protocol as a “Solana killer”. The bullish arguments are also going as far as touting Aptos for outperforming Ethereum. In this article, we will understand what Aptos is, how it works, and how it has the potential to further fuel the rise in its $APT price.

What is Aptos?

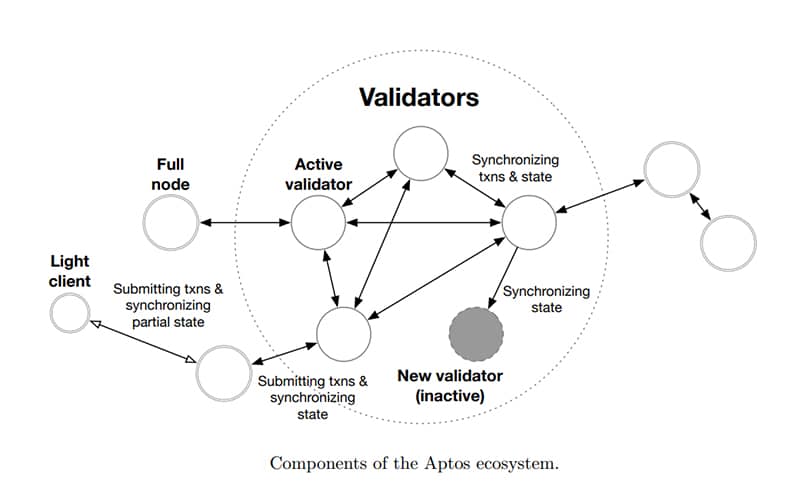

Aptos is a scalable layer-1 proof-of-stake blockchain that uses the Move programming language and promises increased reliability, usability, and security. The Aptos genesis took place on October 12, 2022, with its mainnet “Aptos Autumn” launched on October 17, 2022.

The key features of Aptos are a parallel execution engine, low transaction costs, and high-level security features. The Aptos blockchain has been in the headlines since its launch for both positive and negative reasons. It began with the crypto community backlashing Aptos for being centralized and heavily venture capital-backed with no transparent tokenomics.

However, soon the hype took over and went past all the critics to come out as a promising layer-1 protocol. Aptos garnered attention due to its star-studded founders, namely Mo Shaikh and Avery Ching, combined with its claim to offer technological breakthroughs and be the most secure and scalable decentralized blockchain.

The driving force of Aptos’ popularity was also its strong social media presence that spread across the crypto community like wildfire, resulting in the widespread discussion.

Consequently, its official Twitter handle raked in over 365k followers and interest among people peaked with many becoming its early adopters. Given its history and team, it became a contender in the race among layer-1 blockchains.

Who are the Founders of the Aptos Blockchain?

Aptos was founded by a former Meta’s (Facebook) abandoned Web3 project ‘Diem’ team headed by Mo Shaikh who now serves as Aptos’ CEO and Avery Ching who at present is its CTO. Aptos’ mainnet and token launch were hugely anticipated owing to being created by Diem developers who spent over three years for a successful launch. This means, Aptos already has a solid foundation, to begin with. The team behind Aptos works under the name “Aptos Labs”

The Aptos’ connection with Meta gained so much attention and it made many waves for the claims it made. The key element that “Aptos Labs” proposed was cloud infrastructure as a scalable and cost-efficient platform for building widely-used applications.

Currently, Aptos enables over 19 DeFi projects on the Aptos ecosystem including decentralized exchanges, lending protocols, and liquid staking. Aptos has already raised over $350 million in funding and successfully handled millions of transactions and thousands of nodes.

The funding included a $200 million seed round led by Andreessen Horowitz and another $150 million Series A funding round led by FTX and Jump Crypto. Soon after, Binance also made a follow-on strategic investment to boost the Aptos ecosystem. Speaking of the Aptos ecosystem, it’s time to understand how Aptos work.

Aptos Ecosystem

The development of the Aptos ecosystem is still in the nascent stages. However, the Aptos blockchain has noticed an uptick in activity due to NFT and DeFi projects with more than 94% of transactions being for $APT transfers. Though the Aptos blockchain has negligible DApps activity, its native token $APT reached an all-time high with a 500% rally.

As it has limited activity and ecosystem growth, the future price movements might not be favorable as opposed to its overblown market capitalization. While some experts are predicting a sharp decline in prices as the Aptos token has reached its peak, some analysts have a positive attitude toward the network’s growth. Aptos Labs has made many claims to position Aptos as the safest and most reliable network possible.

One of the most widespread claims is that the Aptos blockchain can theoretically reach 160,000 transactions per second while maintaining security and reliability. Aptos is perceived as more reliable than its rival Solana which has been fairly prone to failures due to outages and downgrades.

On the other hand, Aptos blockchain has already managed to outperform Ethereum in terms of speed. Ethereum’s reliability is unarguably superior but Aptos has the potential to secure its rank under top blockchain platforms in the future. The pressing question here is: what ties Aptos to a hope of being among the best blockchains? Let’s understand its underlying technologies.

How does Aptos Blockchain work?

The Aptos blockchain operations are primarily led by the superior technology narrative. Aptos is still under development to handle over 160k transactions per second using its parallel execution engine (Block-STM) which results in low transaction costs for users.

However, it currently only processes 7 transactions per second as opposed to what it claimed. Aptos also became a meme for over-promising and under-delivering in its first week of trading. Regardless, it is too early to assess how it will perform in the future as the blockchain is still in its infancy.

Most blockchains execute smart contracts either sequentially or with the help of a massive parallel workload for improved performance, resulting in huge power consumption. Unlike other blockchains, a single failed transaction will not hold the entire chain, instead, Aptos processes all transactions simultaneously and validates them afterward.

The failed transactions are aborted and re-executed by its STM (software transactional memory) libraries which manage such conflicts in the network. As per its whitepaper, Aptos employs a flexible programming language “Move”, modified data sharding technology, PoS consensus mechanism, and state machine to achieve a fast, scalable, and secure system.

Aptos’ state machine is the Move Virtual Machine (MVM) which is strikingly similar to Ethereum’s EVM (Ethereum Virtual Machine). MVM converts Move modules to bytecodes which are then executed by the Aptos blockchain. Move modules work just like Ethereum smart contracts. Move modules are code pieces that allow Aptos blockchain to sanction free-running transactions.

With this, Aptos has become the first blockchain to debut Move language and the mainnet is currently using the latest version of AptosBFT (version 4).

In the future upgrade, Aptos labs will develop AptosBFT (version 5). BFT stands for Byzantine Fault Tolerance, which is a consensus protocol with responsive production optimization. This mechanism minimizes the impact of failed validators on throughput and latency. Ultimately, boosting Aptos’ blockchain performance.

Till now, we have established that the underlying technology of Aptos holds untapped potential and can prove to be revolutionary if executed well. Now, let’s understand how its token $APT skyrocketed in no time and what the Aptos token actually is.

What is Aptos Token?

$APT is the native token of the Aptos blockchain and is primarily used to pay for transaction and network fees on its platform. The Aptos blockchain charges a fee on all transactions on the network and is specified in Aptos tokens (APT).

Validators can prioritize the highest-value transactions on the Aptos network and discard transactions of lower value. This way, blockchain operates efficiently when the system is at capacity.

Over time, network fees will also be implemented, bringing the cost of utilizing Aptos into line with the cost of installing, maintaining, and running nodes.

To be a validator, you must hold a minimum number of staked $APT to participate in transaction validation. Being a validator has the advantage of deciding on the division of rewards between themselves and their respective stakers.

On the other hand, stakers can choose a number of validators to stack their Aptos tokens to get a pre-agreed split of rewards. As such, rewards are distributed to validators and stakers at the end of every epoch.

Currently, the maximum reward rate for stakers is around 7% per annum. The staking reward amount is evaluated at every epoch. The maximum staking reward will decrease by 1.5% per year until it reaches 3.25% per year, as mentioned in its whitepaper. Note that, all reward amounts and mechanisms can be changed by governance voting.

$APT is of course a governance token, which can be used for voting on upgrades and proposals to the protocol and on/off-chain processes.

Initially, tokenomics of $APT was quite controversial as it was released without disclosing the total supply, distribution, and overall plan. Later, Aptos labs revealed its tokenomics that cleared the air in the crypto space.

Aptos mentioned, out of 1 billion tokens in initial supply, 51% was allocated to the “community” category, 19% to “core contributors,” 16.5% to the “foundation,” and 13.48% to the investors.

Where to buy Aptos tokens?

Aptos has recently collaborated with MoonPay to allow Petra wallet fiat on-ramps. Hence, users can now buy $APT using Mastercard, Visa, Google Pay, and Apple Pay.

The $APT token can also be purchased and traded on crypto exchanges including Binance, Coinbase, OKX, and Digifinex.

Among them, Binance is offering spot trading pairs such as APT/BTC, APT/BUSD, and APT/USDT. Crypto exchanges listing $APT trading pairs, Aptos’ social media presence, the underlying technology, the former Diem team, and ongoing partnerships are all working in favor of attracting more traders to hoard Aptos tokens.

Is Aptos’ token $APT worth the hype?

The crypto community is witnessing a lot of chatter on Aptos emerging as the best-performing layer-1 protocol with Aptos prices pumping 500%. It’s true that Aptos offers promising features that are unique and cannot be found in other layer-1 protocols, except Sui which was also a Diem-based blockchain.

Though Aptos has the potential to compete with Ethereum and Solana in terms of scalability and overall network capacity, it is heavily backed by VCs. This makes it susceptible to incidents like FTX collapse. However, it is rapidly moving towards decentralization with the deployment of many DeFi projects and is constantly working on scalability and technology.

Aptos Labs, as it is made up of the former Meta team, can hold itself true to its reputation to make it a success.

On the other hand, Aptos tokens have already reached their peak, which suggests it has a tendency to show a bearish trend in the coming weeks. It’s tricky to determine whether Aptos tokens are worth the hype as many layer-1 solutions dwindled in 2022 that claimed to be “Ethereum killers.” It would still be interesting to see how Aptos holds its rank among the best performing tokens in the coming months.

Also Read: Ethereum Price Prediction 2023: Can ETH hit $2500?

FAQs

1. Where is Aptos listed?

Aptos is listed on Binance, Coinbase, OKX, KuCoin,Bitfinex, Bybit, Kraken and Digifinex and many other crypto exchanges.

2. Is Aptos faster than Solana?

Both Aptos and Solana have similar levels of speed as they both utilize engines that can run computations in parallel. However, users have begun perceiving Aptos as a more reliable option.

3. How fast is Aptos blockchain?

Aptos currently handles 7 transactions per second. However, it claims to handle 160k transactions per second in the near future.