As much as the year 2022 was about unnerving crypto winter, abrupt collapses, and bankruptcies, it was also the year of the most-anticipated and revolutionary upgrade, “Ethereum Merge.” Several events, notably the Terra stablecoin collapse in May, the FTX bankruptcy in November, and the struggle that followed by other crypto firms to stay afloat in a bearish condition, had ripple effects.

This series of events not only negatively affected crypto players but also dampened the confidence of people who were expecting Ethereum to go five digits with the Merge upgrade. Though it’s good to be optimistic, Ethereum price predictions for 2023 arguably have other plans.

Ethereum’s attempt in 2022 to become a major catalyst in bringing an uptick in activity in the crypto market had little to no effect on prices. However, we could expect Ethereum to gain traction in 2023 and ignite a notable bull run as ETH prices have begun climbing up. If you’re interested in staying informed about how Ethereum is performing in the market, World Coin Stats Ethereum provides an in-depth and current overview of its behavior.

As we are still in the thick of a bear market which is now appearing to be bottoming out, everybody is preparing for an upcoming bull run. Also, if you are looking for a place to swap coin now, you may use one of the anonymous instant exchanges.

Traders have again tightened their grip and are ready for Ethereum to make a sharp rebound. Now, let’s begin testing how much this optimism holds true to the current market scenario with Ethereum price predictions for 2023.

Ethereum Price Prediction for 2023 based on Technical Analysis

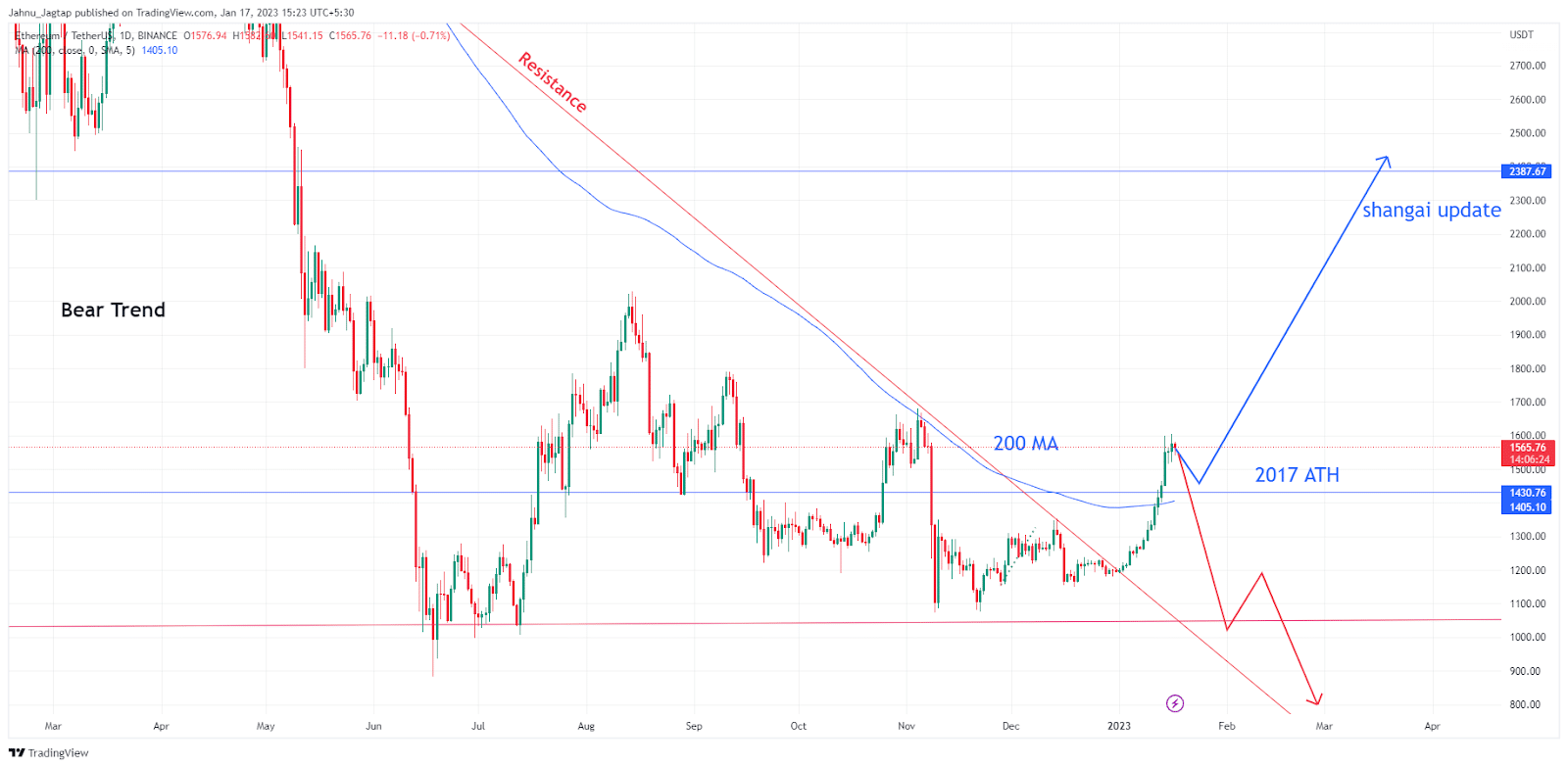

Now, on practical grounds, the technical analysis adds another perspective to Ethereum price predictions for 2023. In the graph given below, you can see Ethereum was hovering below the crucial resistance for several months in 2022 and has now (in 2023) begun to cut through these levels and show an uptrend.

Ethereum is ranging high and has crossed daily 200 MA with its price touching the $1500 mark, at the time of writing. From here onwards, there are two possible scenarios in Ethereum price movement.

- As per our Ethereum price predictions for 2023, the ETH price can temporarily have a minor pullback while testing the support of the previous ATH ($1420) and 200 MA.

It’s expected that ETH prices can rise beyond these levels, as the Shanghai update is around the corner, indicating the trend will be strong enough to push ETH price up to $2500.

- It is also possible that Ethereum’s attempt to lay down a notable upswing can be a big fail, dropping its price below 200 MA and previous ATH levels. This condition will drive ETH prices to settle below $1000.

Ethereum Price Prediction for 2023 based on the wider crypto market

The beginning of 2023 has proved to be largely bullish as the ETH price surged beyond $1300 at the movement. Though bearish conditions may not cease to be zero, in the coming days the strong bullish push from the Shanghai update may enable the price to rise to near $2500.

This would partly be possible due to Bitcoin price movements in 2023. Bitcoin price prediction for 2023, suggests that Bitcoin has crossed its long-term resistance and its prices may slope up in anticipation of the Bitcoin halving event that will take place in 2024.

With this, other cryptocurrencies will see a price surge, and the overall market scenario will turn bullish. Ethereum prices will also rise to find new highs thereafter. All these favorable Ethereum price predictions for 2023, will probably not come into action until Q3 of 2023.

Ethereum Price Prediction Takeaway

From our Ethereum price prediction for 2023, you can now expect that ETH prices may range close to $2500, expecting the Shanghai upgrade. In case the bulls fail to pick ETH prices up, we might see a steep downfall that can bring it back below $1000.

On the other hand, the Bitcoin price surge can be a pivotal turn for the crypto industry at large, working in favor of every cryptocurrency, ETH will more likely also enjoy the uptrend in 2023.

Ethereum has largely been consistent since it became the second-largest cryptocurrency in trading volume after Bitcoin. Hence, its tendency to rebound is historical yet calculated price swings are possible.

Though Ethereum price predictions are based on technical and market analysis, close observations of the price movements should not be avoided at all times.