Kyber Network has launched Launched its new AMM “Kyber Dynamic Market Maker(DMM)“. Rewarding Liquidity providers with KNC tokens under its “Rainmaker Liquidity mining program“. Users can earn ~50% APY on Ethereum through Liquidity Mining.

Kyber DMM a decentralized Exchange is designed to Amplify Liquidity, Providing high capital efficiency and dynamic fees structure to boost return. DMM is currently in its beta phase. It has already surpassed $320M in Total Value Locked with $155M Trading volume and $33B+ in total amplified liquidity (equivalent TVL when compared to typical AMMs).

On 30th June, the Rainmaker program has started distributing ~$25M in rewards over the course of 3 months to eligible liquidity providers(LPs) on Kyber DMM.

Rainmaker Liquidity Mining Instructions:

Check this example to earn ~50% APY by providing Ethereum-USDT as liquidity

Step 1: Adding Liquidity in ETH-USDT Pool

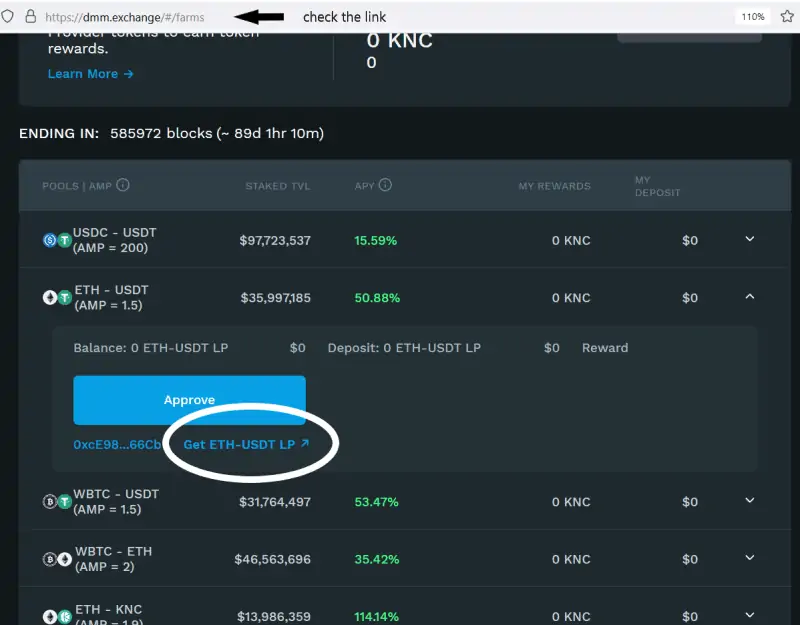

- Go to https://dmm.exchange/#/farms

- Connect your wallet via Metamask, Ledger, WalletConnect, Coinbase Wallet.

- Select eligible pool, (we are demonstrating ETH-USDT~50%)

- Click Get ETH-USDT LP↗

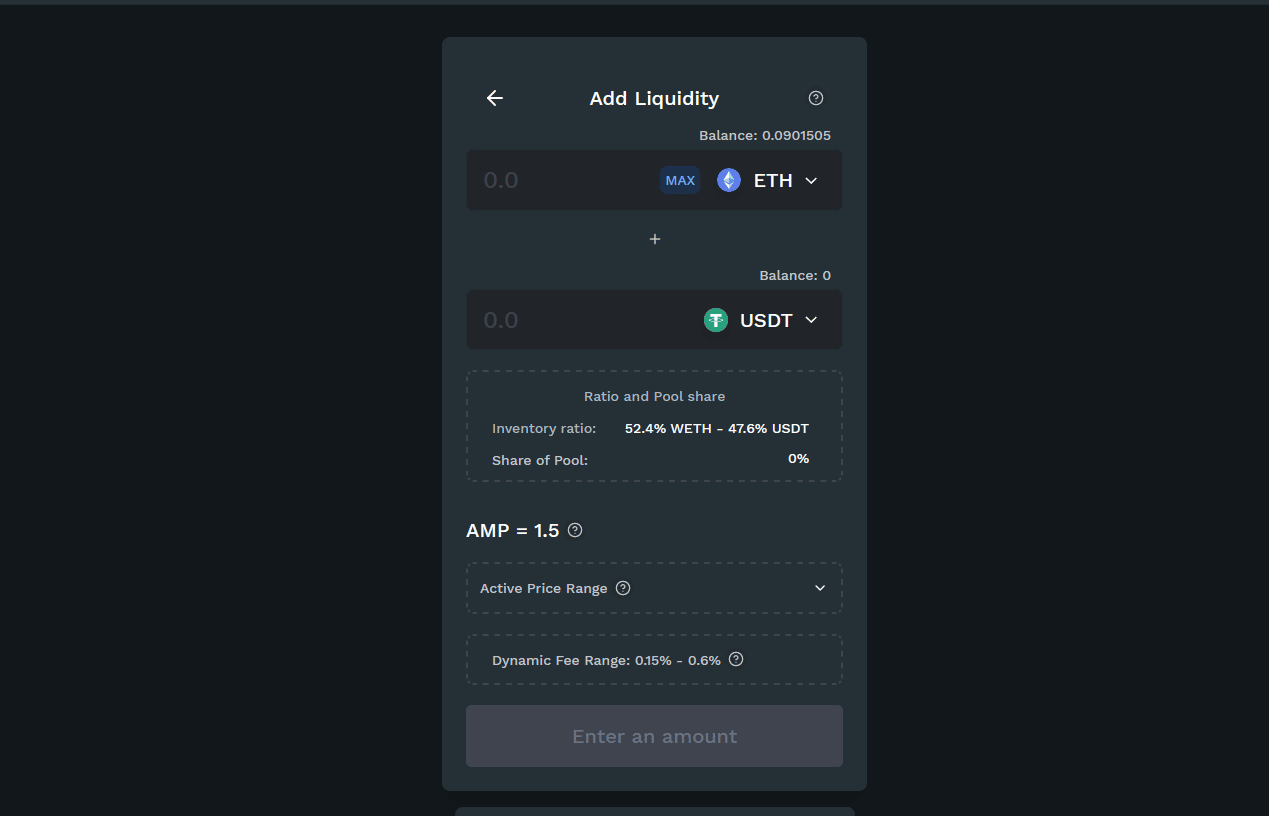

- Click Add Liquidity (Inventory ratio is 52.44% WETH – 42.56% USDT)

- After adding liquidity you would receive KyberDMM LP WETH-USDT Token in your wallet.

Step 2: Staking Liquidity (LP Token) for KNC Rewards

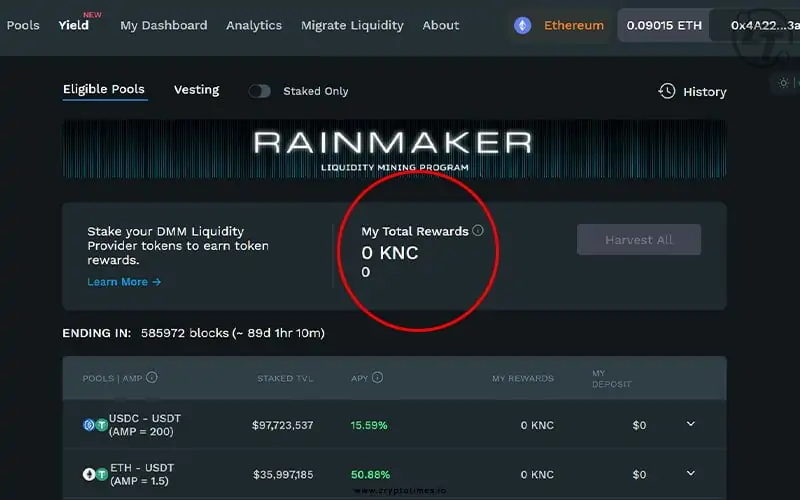

- Now go back to https://dmm.exchange/#/farms

- Select ETH-USDT pool

- Click max and click stake.

- Done now you should be able to see the rewards on top of the page.

Important Information About KNC Rewards.

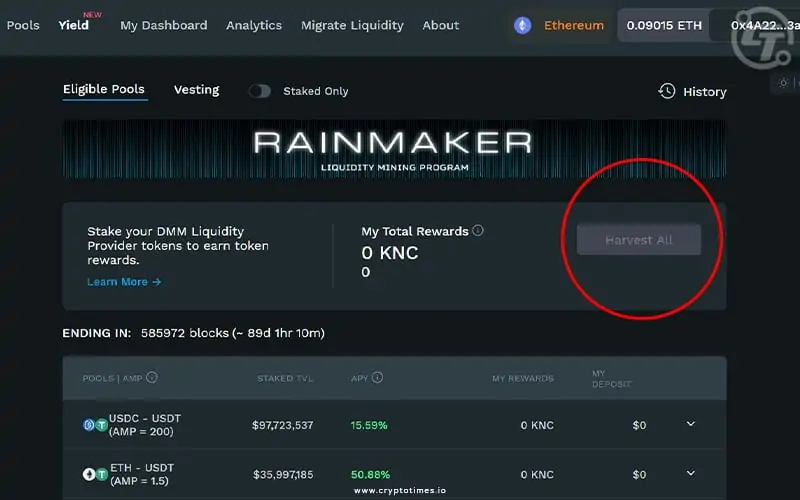

Claiming rewards: you can claim your rewards by clicking “Harvest ALL”

Harvested rewards will be available for you to withdraw over the course of 30 days. So you will be able to spend your rewards once the Vesting schedule is over. You can claim your KNC by going to Vesting -> claim all.

The rewards will be in KNC token which is Kyber Network Governance Token, Presently trading at 1.50$.

You can swap KNC into ETH or BTC by swapping it on DMM exchange or you can use Binance.

The rewards are calculated on the basis of the present liquidity in the pool. For example earlier when we deposited our liquidity on the ETH-USDT pool the rewards were over 200% APY since the TVL was under 5M, as of right now the TVL on ETH-USDT is ~$35M and it’s still giving 50% APY, maybe in future it decreases on increases on basis of its TVL.

-DO REMEMBER THAT OTHER THAN USDC-USDT POOL, ALL OTHER POOLS ARE SUBJECT TO IMPERMANENT LOSS, WHICH OCCURS DUE TO PRICE VOLATILITY.