In a recent Singapore event, Chainlink expressed its keen interest in bringing “cryptographic truth” to the financial system and announced its plans to execute exactly that.

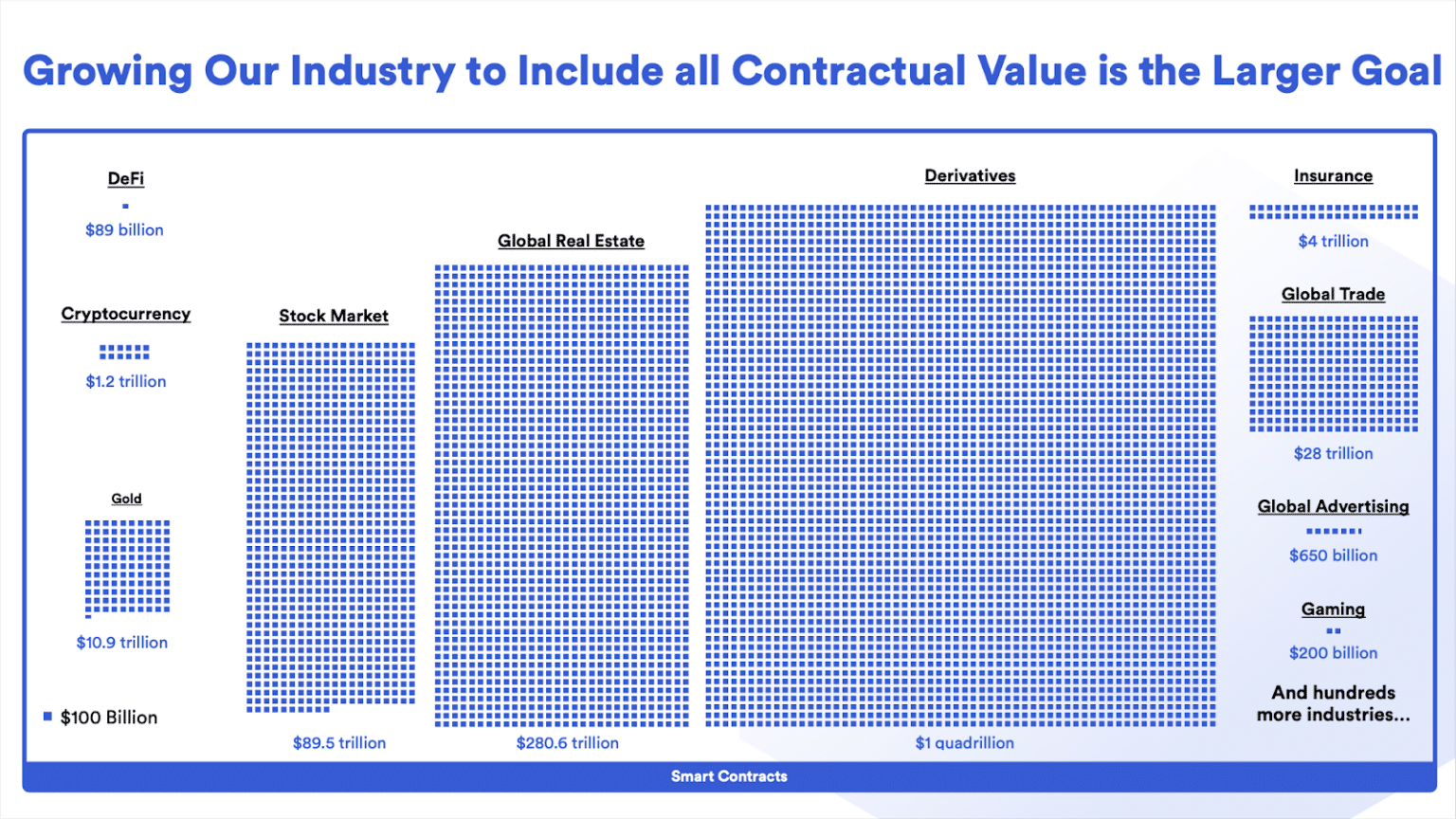

The entire focus is transforming capital markets into on-chain finance, which is set to shift more than $867 trillion in global asset value. The main character is Chainlink. And banks, the sidekick.

What is it that Chainlink is trying to achieve with the aim of incorporating traditional banking into its ambit? And why is the crypto industry all optimistic about Chainlink’s goal to scale tokenized asset adoption? Let’s find out.

Chainlink

Chainlink is a Web3 services platform. It’s a decentralized oracle blockchain network built on Ethereum. Ethereum, for those who don’t know, is a blockchain network in itself that uses the Ether token to make transactions.

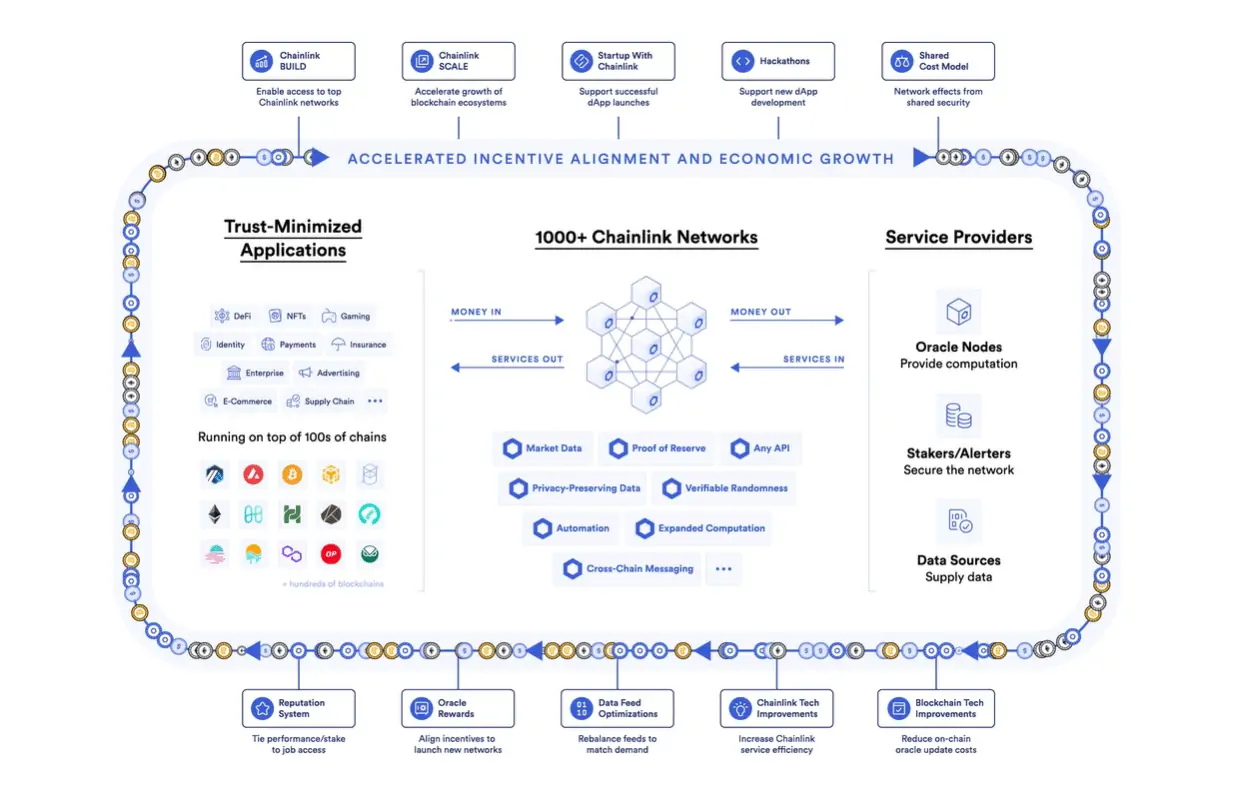

Oracle is the technology that allows a blockchain network to be connected to external systems; it is Chainlink’s ‘link’ to the external world. Using Oracle, networks can inject verified inputs from the real world into their networks. Smart contracts employ oracles to execute the contracts and perform their functions.

Chainlink’s Latest Mission

It aims to link off-chain data with on-chain data. More specifically, replatforming traditional financial systems on a blockchain network. To execute this initiative, it will leverage its native system: CCIP

Chainlink CCIP

The Chainlink CCIP: Cross-Chain Interoperability Protocol plays a very critical role in Chainlink’s mission.

The protocol enabled DeFi applications to interact with users and other DeFi platforms on other blockchains through a unified interface. Additionally, CCIP facilitates the integration of traditional financial systems with both public and private blockchains, simplifying the process of shifting existing assets and financial services onto blockchain networks.

According to the official website, if successful, this initiative has the potential to attract trillions of dollars in new assets to the world of blockchain ecosystems.

Some Additional Features of CCIP

There are certain features that make CCIP a leader in the cross-chain space. This includes implementing rate limits on token transfers to minimize potential risks and introducing the Risk Management Network, an autonomous network that verifies cross-chain operations for any potential errors.

CCIP also employs Smart Execution, a gas-locked fee payment mechanism. With Smart Execution, users only need to pay fees on the source chain, and CCIP handles the execution on the destination chain.

Currently, CCIP is operational on Mainnet for Early Access participants, including two prominent DeFi protocols:

- Synthetix: It benefits from CCIP as it enables synth tokens to move seamlessly across different chains, improving liquidity and capital efficiency where there is immediate demand.

- Aave: The protocol is integrating CCIP to enhance its multi-chain governance system, resulting in time and resource savings for developers and increased protocol security.

As per Kain Warwick, the founder of Synthetix, “Security is of utmost importance when dealing with on-chain assets, which is why we utilize Chainlink CCIP for our cross-chain Synths Teleporter.”

What Problem is Cross-chain Network Solving?

In recent years, the cross-chain ecosystem has faced challenges, with past cross-chain solutions encountering vulnerabilities resulting from suboptimal design decisions, extensive attack vectors, and intricate user interfaces.

These issues have led to over $2.6 billion in losses from cross-chain bridge breaches. According to Chainalysis, cross-chain bridge breaches were responsible for 64% of the funds stolen in DeFi hacks during 2022.

Chainlink believes that the industry requires a cross-chain solution that offers elevated levels of security, dependability, and user-friendliness.

Moreover, there have been persistent obstacles in the way of transferring assets worth hundreds of trillions of dollars onto blockchain technology:

- Blockchain Connectivity (Moving from Legacy Systems to Blockchain): The capability to link the fundamental operational framework of existing financial systems with various blockchain platforms.

- Cross-Chain Interoperability (Connecting Different Blockchains): A highly secure communication standard that facilitates the connection of different public and private blockchain networks.

Chainlink CCIP’s partnership with the interbank messaging system ‘Swift’ aims to facilitate seamless communication between traditional legacy systems and blockchain networks. The collaboration will also establish interoperability between public and private blockchain networks.

More than a dozen major global financial institutions and financial infrastructure providers, such as DTCC, BNY Mellon, Citi, and Euroclear, are actively involved in this joint effort.

Currently, Chainlink is focused on executing the interoperability of DeFi apps across chains and also the interoperability of banks on-chain. The next step includes facilitating interoperability between the two sectors—DeFi and banks. This initiative will expand use cases for projects in its ecosystem.

The industry currently occupies a space of around a trillion dollars in the global economy. Experts believe that once it publically establishes security and reliability (comparable to those of traditional financial systems), along with creating seamless pathways for external inputs to reach the blockchain, Chainlink has the potential to be the leader in an industry worth hundreds of trillions of dollars.