The current crypto buzz is the rise in Bitcoin price as well as the surge in other altcoin prices. Yes! In the last few weeks, Bitcoin has witnessed a remarkable upswing in price, and crypto enthusiasts and traders have been asking the one burning question—will Bitcoin break through the $100,000 barrier?

While there has been speculation that the currency reaching a new all-time high of $100,000 would make investors richer, fuel increased investment in crypto, and legitimize the whole crypto market as an alternative to traditional investment, others are of the opinion that it might take a while to get to these highs, aside from the fact that it would attract scrutiny from regulators and tax authorities.

In this article, we will examine the factors fueling the recent Bitcoin surge and its future implications, as well as what to expect.

Why Bitcoin (BTC) price is Surging

On March 8, the price of Bitcoin reached a new all-time high of $70,170, continuing its rally triggered by the approval of a Bitcoin spot ETF. This steady trajectory can be traced from September last year.

In fact, as of this writing, Bitcoin is at $68,762.16, which is a total return for 2024 of more than 42%, with a nearly 7% gain in 24 hours. With this current price, BTC has already reclaimed all of the ground lost since the start of crypto winter in May 2022, and it is steadily approaching its all-time high of $64,000, established in November 2021.

Why Bitcoin(BTC) is rising?

The recently positive mood in bitcoin stems from a surge of crypto investor excitement following the US Securities and Exchange Commission’s mid-January approval of 11 spot bitcoin exchange-traded funds, or ETFs.

A little over $577 million has gone into spot bitcoin ETFs.

Spot Bitcoin ETFs allow institutional investors to trade Bitcoin at its current price. Previously, Bitcoin ETFs could only trade Bitcoin futures, which are complicated derivative products that professionals can only trade.

Following the SEC’s decision to approve one of the initial U.S. spot bitcoin ETFs, the oldest known cryptocurrency has surged more than 42% year-to-date, increasing from less than $50,000 at the time of certification to well than $60,000 today.

Key Factors Influencing Bitcoin Price

1. Market Demand

Institutional actors such as hedge funds, family-owned businesses, and publicly traded firms have entered the Bitcoin market, changing the game. These wealthy investors contribute enormous resources and credibility to the cryptocurrency market, resulting in increased demand and price gain.

As more financial institutions commit a percentage of their portfolios to Bitcoin, it indicates an increasing recognition of the virtual currency as an appealing financial instrument, which will boost its widespread adoption.

2. Macro Trends

Bitcoin’s price swings are frequently influenced by larger economic and geopolitical trends. During economic turmoil or financial crises, investors seek different investments like Bitcoin to protect them from currency depreciation, stock market volatility, and the instability of established financial systems.

Furthermore, fears about rising inflation due to central banks’ expansionary monetary policies have boosted Bitcoin’s attractiveness as a potentially inflationary-resistant store of value, considering its fixed supply cap. Some investors see Bitcoin as an electronic form of gold, a safe haven commodity during troubled times.

What does this mean for Investors?

While Bitcoin seems to be at the height of a strong bull run, it is impossible to predict the extent to which the digital currency will go before experiencing another downturn.

While bitcoin appears to be once again on a long-term upward trend, the truth is that we are in uncharted territory in terms of various elements, including the geopolitical atmosphere, economic data, digital currency regulations, and the Fed’s interest rate intentions.

Investors in the cryptocurrency business have discovered that predicting the short-term price action of digital assets is challenging even when conditions are ideal. That is especially true in this market scenario.

What to Expect with an Increase in Bitcoin Price

1. Increasing Global Adoption

Bitcoin’s potential breach of the $100,000 mark could be a watershed moment, accelerating mainstream cryptocurrency adoption worldwide. With a current market capitalization of around $2 trillion, the crypto space still has immense growth potential compared to traditional asset classes.

Hitting this milestone could legitimize digital assets as viable investments, attracting institutional investors, pension funds, and governments to allocate capital. This influx of institutional money could enhance market stability, drive regulatory frameworks, and foster financial innovation.

Moreover, cryptocurrencies’ borderless nature could disrupt global finance by challenging fiat currency dominance and democratizing access to secure, transparent transactions.

A Bitcoin triumph over $100,000 could cause a change from a niche market to a transformative force reshaping international commerce, remittances, and financial inclusion on an unprecedented scale.

2. DeFi 2.0

With Bitcoin Price surging past $100,000, we are likely to have the next wave of innovation in decentralized finance (DeFi).

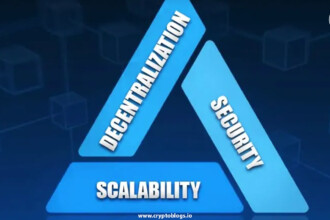

DeFi, a subset of crypto aiming to replicate traditional financial services in a decentralized, transparent, and permissionless manner, has already gained traction with over $70 billion in total value locked across various protocols. However, it still struggles with scalability, security, and user-friendliness challenges.

A new all-time high for Bitcoin could attract more developers, investors, and users to experiment with DeFi 2.0 solutions that tackle these issues and unlock novel opportunities.

These could encompass advanced smart contract platforms, interoperability protocols, privacy-enhancing technologies, and intuitive interfaces to make DeFi more accessible to mainstream users.

3. New Cryptocurrency Billionaires

An immediate consequence of Bitcoin reaching $100,000 would be the creation of newfound wealthy investors. This wealth generation could further propel the crypto industry’s growth, as affluent individuals seek to invest in Bitcoin and other digital assets.

However, it may also attract heightened scrutiny from regulators and tax authorities keen on ensuring these riches are not derived from illicit or fraudulent activities. Authorities may tighten oversight and implement stricter measures to combat potential money laundering, tax evasion, or other financial crimes associated with the sudden influx of crypto wealth.

Striking a balance between fostering innovation and mitigating risks will be crucial as Bitcoin’s ascent reshapes the global financial landscape.

Conclusion

Finally, Bitcoin reaching $100,000 or above will shake the crypto industry and usher in a new turn of events, reshaping the global financial space. From fostering increased adoption of cryptocurrency to attracting institutional capital and fielding decentralized finance, which, in the end, will generate immense wealth.

While it is yet uncertain if Bitcoin will ever reach an all-time high of $100,000, the currency seems to show a promising future, and other events in teh coming month might propel this news price uptrend.

In the meantime, it is necessary to benefit from the uptrend.