The recent approval of a spot Bitcoin ETF (exchange-traded fund) has brought the cryptocurrency world back into the limelight. This significant event is expected to increase significantly the price of BTC, as it will draw billions of dollars from traditional finance into the crypto sector.

Many traders, investors, and crypto analysts believe that the spot Bitcoin ETF will take the crypto market to new heights. Yet, this is just the beginning of merging traditional finance with decentralized finance (DeFi).

Following Bitcoin, Ethereum (ETH) is seen as the next likely candidate for ETF exposure. To dive deeper into the conversation around Bitcoin and Ether ETFs, let’s first understand what an ETF is.

What Are ETFs?

ETFs, or Exchange-Traded Funds, are investment tools that track the price of underlying assets and can be bought and sold on stock exchanges. There are different types of ETFs, including spot, future, and leveraged ETFs, each catering to various investment strategies.

Moving on to Crypto ETFs, these are special types of funds that focus on cryptocurrencies like Bitcoin and Ethereum. Crypto ETFs offer a straightforward way for investors to get involved in the cryptocurrency market without the complexities of purchasing and securely storing the digital currencies themselves.

This makes investing in crypto more accessible and less daunting for those unfamiliar with the digital asset space.

History of Crypto ETFs

10 January 2024 was a historical day for Bitcoin when the U.S. Securities and Exchange Commission (SEC) finally gave a green signal to spot Bitcoin ETFs. This approval allowed the trading of Bitcoin on regulated stock exchanges at market price.

However, it was not the first crypto ETF as the agency had previously approved Bitcoin futures ETFs in October 2021. Following this launch, the futures ETF for Ether (ETH) were also made available later in 2023. This move gives a solid probability that spot ETH ETFs will be also approved sooner, which is expected around May 2024.

Bitcoin ETF vs Ethereum ETF

The answer to this question is as elaborative as the comparison between Bitcoin and Ethereum. Both of these crypto assets are market leaders and largest in terms of market capitalization. While Bitcoin is known as the largest cryptocurrency in the world, Ethereum has taken over DeFi space by storm through its limitless potential.

Investing in Bitcoin will be mostly based on price speculations on inflow, outflow, recent events, etc., whereas investing in Ethereum is based on technical advancements and DeFi market primitives.

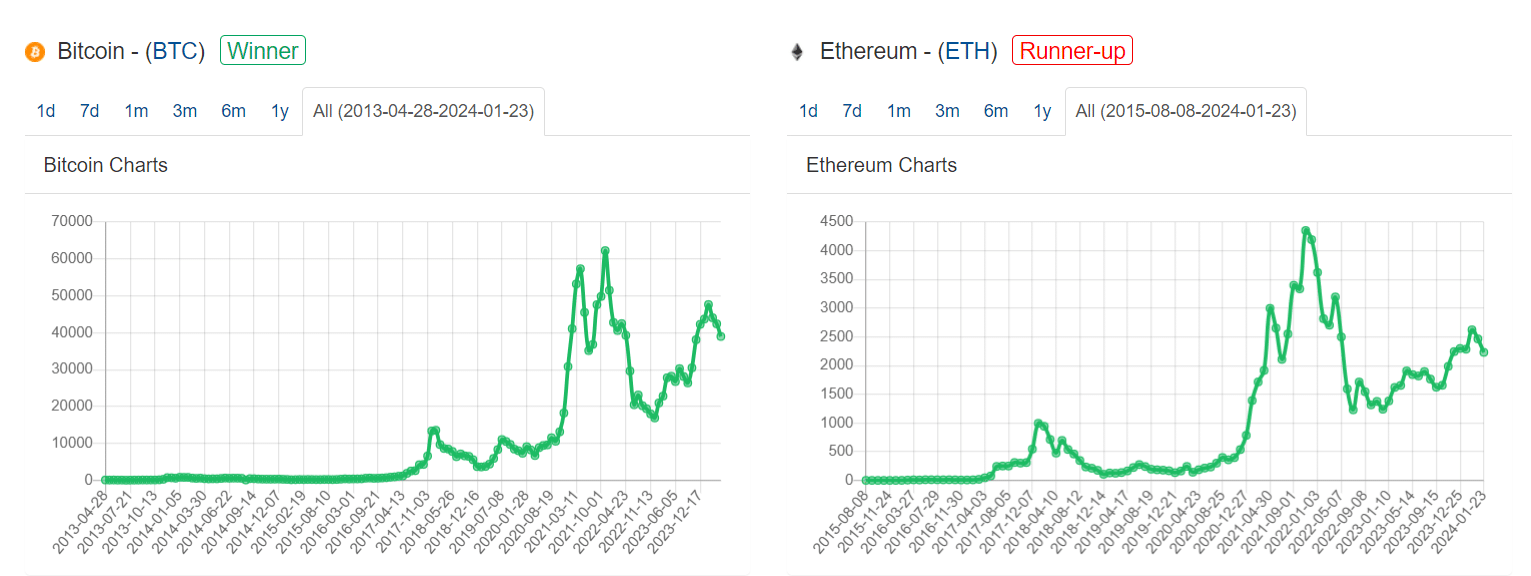

These asset prices are correlated, and Ethereum usually accompanies Bitcoin in price pumps and dumps. Choosing one to invest between both is as feasible as ordering dishes in a new restaurant. When it comes to market performance, Bitcoin has often outperformed Ethereum in every timeframe.

Case Study: Investing In Bitcoin ETF

Bitcoin is the largest crypto asset, and spot ETFs have extended its exposure to trillions of dollars of traditional economy. It has also been the most popular choice among crypto investors.

Investing in Bitcoin ETF will be beneficial in the longer term. According to several analysts, the gradual inflow from traditional finance is expected to push Bitcoin to a new all-time height by the end of 2024. The approval of the spot Bitcoin ETFs was a major catalyst that pushed Bitcoin to yearly highs, but it failed to maintain the bullish momentum.

Another bullish catalyst for Bitcoin is the upcoming fourth halving, which could also bring some positive impact on the crypto market. Based on previous halving events, Bitcoin halving is usually considered a bullish sentiment for Bitcoin. During the past three halving events, Bitcoin’s price has seen huge spikes, which are expected to be repeated during this cycle as well.

Bitcoin is currently going through a correction phase, and it is expected to catch upward momentum after the halving, which is due in April. The timeframe between post-ETF correction and Halving is ideal for investing in Bitcoin or Bitcoin ETF.

Case Study: Investing In Ethereum ETF

However, spot Ethereum ETFs are not yet available to invest as the SEC has not shared the final decision for its approval. The deadline for the ETF approval decision is currently uncertain, but several analysts have predicted that the date will be somewhere around July 2024.

The approval of spot Bitcoin ETFs opened doors for thousands of other crypto assets to be made available on stock exchanges. Several crypto analysts have also confirmed that spot Ethereum ETFs are inevitable as futures ETFs are already in the market.

The optimism around spot Ethereum ETF is already benefiting ETH price as the ETH/BTC ratio has been getting shortened recently. Ethereum is long-awaiting a major spike that can push its dominance further in the crypto space, which is only 17%, while Bitcoin has over 50%. The upcoming Dencun upgrade on Ethereum is also expected to bring significant changes to the network as well as the ETH price.

Investing in Bitcoin or Ethereum ETF is not just limited to price speculations. Advanced trading algorithms and technical analysis also help to find better entry into the market.

Let’s see some popular strategies that are used by traders and investors;

Popular Investment Strategies

1. Historical Gains in BTC & ETH Price

While going through a major bullish stance, Bitcoin recorded a growth of 155% while Ethereum price rose nearly 90% in 2023. Indicators like capital inflow-outflow, price pumps, market corrections etc., helps traders and investors in taking better market positions which can be related to Bitcoin or Ether.

2. Utility & Supply Mechanism

From a technical perspective, ETH has more room to expand itself as an utility asset which is used for transaction fees on Ethereum blockchain as well as for staking. Bitcoin was previously only used for transactions but it has also seen innovative applications within the ecosystem which made it possible to give utility to BTC other than just transaction fee.

3. Ecosystem Growth & Primitives

The ecosystem around crypto assets could also play a vital role in price performance. As the blockchain ecosystem grows, the demand for its native currency also increases. For instance, when the DeFi activity peaked in 2020, the user demand for Ether also increased. Same happened to Bitcoin recently after BRC-20 tokens and Ordinals became popular.

Also Read: How Excitement Around Bitcoin ETF Approval Is Influencing the Crypto Space

Conclusion:

When it comes to choosing Bitcoin or Ethereum, most investors opt for Bitcoin as it holds the dominating image of being the first and biggest crypto asset. Crypto investments other than Bitcoin are often considered too risky as the crypto industry is infamous for financial aspects.

However, Ethereum has also been dominating as the second-largest crypto asset for the past few years. It has won investors’ trust by continually being an alternative investment option to Bitcoin, which is much more volatile.

The Enthusiasm around post-Bitcoin ETF inflow and ETH ETF approval hype will likely set both of these assets on fire in the coming months. The next six months are going to be crucial for the crypto space as the Bitcoin Halving is merely two months away, and the SEC is also likely to share its decision on spot Ether ETF in May.

The year 2024 will surely make crypto a lucrative place for traders, investors, and all others associated with the cryptocurrency industry.

Note that this article is just for educational purposes and is based on research done by our team. The Crypto Times does not advise making decisions or encouraging any kind of crypto investment without risk consideration. Make an investment at your own risk.

FAQs

Q. 1 When spot Ethereum ETFs will be approved?

Answer. The SEC is likely to share its final decision for spot Ethereum ETF in May 2024.

Q. 2 Which is better: Bitcoin or Ethereum?

Answer. Bitcoin and Ethereum both are the largest crypto assets and both have the potential to reach new heights.

Q. 3 Which crypto assets provide the best return: Bitcoin or Ethereum?

Answer. When it comes to returns, Bitcoin has most often outperformed Ethereum with its price gains and Ethereum tends to follow it.