The traditional digital currencies face a number of challenges and to address the pain points Bitcoin Cash has emerged as a groundbreaking solution. Derived from Bitcoin through a hard fork, Bitcoin Cash offers enhanced scalability and expedited transaction processing, making it a compelling choice for individuals and businesses alike.

In this comprehensive article, we will delve into the intricacies of Bitcoin Cash, exploring its origins, core features, benefits, and potential impact on the financial landscape. By the end, you will have a solid understanding of why Bitcoin Cash is poised to shape the future of digital currency.

Before we start a deep dive into the interesting story behind Bitcoin cash lest just understand what it is.

What is Bitcoin Cash?

Bitcoin Cash is a cryptocurrency, created from a hard fork from the Bitcoin blockchain in 2017. It is a permission-less open network that brings sound money to the world, fulfilling the original promise of Bitcoin as “Peer-to-Peer Electronic Cash”.

Origins and Evolution

Bitcoin Cash came into existence on August 1, 2017, as a result of a hard fork from the original Bitcoin blockchain. The primary motivation behind this fork was to address the scalability issues faced by Bitcoin, particularly the limitations imposed by its small block size. By increasing the block size from 1MB to 8MB, Bitcoin Cash paved the way for more efficient transaction processing, higher throughput, and improved scalability.

The original Bitcoin blockchain had a block size limit of 1 megabyte (MB). This limit was put in place to prevent the blockchain from becoming too large and unwieldy. However, as the popularity of Bitcoin grew, the block size limit began to cause problems. Transactions began to take longer to process and fees began to rise.

Some developers believed that the block size limit should be increased to allow for more transactions to be processed per block. Others believed that the block size limit should remain in place to prevent the blockchain from becoming too large and centralized.

The disagreement between these two groups of developers led to the Bitcoin Cash hard fork. The Bitcoin Cash blockchain has a block size limit of 8 megabytes, which is much larger than the 1 megabyte limit of the Bitcoin blockchain. This larger block size allows for more transactions to be processed per block, which in turn reduces transaction fees and speeds up transaction confirmation times.

In addition to increasing the block size limit, Bitcoin Cash also made a number of other changes to the Bitcoin protocol. These changes include:

- Increasing the number of signature verifications per block from 6 to 32

- Changing the difficulty adjustment algorithm

- Removing the Segregated Witness (SegWit) soft fork

Bitcoin Cash has been controversial since its inception. Some people believe that it is a legitimate upgrade to Bitcoin, while others believe that it is a flawed copy of Bitcoin. The future of Bitcoin Cash is uncertain, but it remains a popular cryptocurrency with a large community of supporters.

Also Read: The Evolution of the Bitcoin Ecosystem: A Guide to Forks and Splits

Here is a brief timeline of the origins and evolution of Bitcoin Cash:

- 2009: Bitcoin is created by Satoshi Nakamoto.

- June 2017 – A group of developers and miners on Bitcoin put forward a proposal called Bitcoin ABC, which wanted to increase the block size.

- July 2017 – Not everyone agreed on the proposed change.

- August 2017 – Bitcoin hard forks, leading to the creation of Bitcoin and Bitcoin Cash.

- March 2018 – Bitcoin Cash payments accepted on BitPay.

- May 2018 – Bitcoin Cash increased block size from 8 MB to 32 MB.

- November 2018 – Bitcoin Cash went through another hard fork, to create Bitcoin Cash and Bitcoin SV.

- November 2020 – Bitcoin Cash forked a third time, this time to Bitcoin Cash Node (BCHN) and Bitcoin Cash ABC (BCHA), and Bitcoin Cash Node went on to be called Bitcoin Cash (BCH).

- June 2021 – SmartBCH, a Bitcoin Cash sidechain, was launched.

- May 2023 – Integration of Cashtokens, Allow Transactions to be smaller, P2SH32, Restrict Transaction Versions.

- June 2023: EDX, the digital asset exchange backed by Wall Street giants Fidelity, Citadel and Charles Schwab, announces it will list BCH

Key Features of Bitcoin Cash

- Enhanced Scalability:

The increased block size of Bitcoin Cash allows for a significantly higher number of transactions to be included in each block, ensuring smoother and faster processing. This scalability enhancement is a crucial factor in accommodating the growing demands of a global digital economy.

- Expedited Transaction Confirmations:

Bitcoin Cash offers faster transaction confirmations compared to Bitcoin, thanks to its larger block size. This feature significantly reduces the waiting time for users, making Bitcoin Cash an ideal choice for time-sensitive transactions.

- Lower Transaction Fees:

Bitcoin Cash transactions typically come with lower fees compared to Bitcoin. The larger block size and improved efficiency of transaction processing contribute to reduced costs, making Bitcoin Cash an attractive option for cost-conscious users.

- Decentralization and Security:

Like Bitcoin, Bitcoin Cash operates on a decentralized blockchain, ensuring the security and integrity of transactions. The robust network of miners and nodes collectively maintains the blockchain, preventing any single entity from exerting control over the network.

Benefits for Users and Businesses

Bitcoin Cash offers a wide range of benefits that cater to the needs of both individual users and businesses operating in the digital economy. Let’s explore some of the key advantages:

- Speed and Efficiency:

With faster transaction confirmations and enhanced scalability, Bitcoin Cash enables users to complete transactions swiftly and efficiently. This speed is particularly beneficial for e-commerce businesses, where timely payments are critical for customer satisfaction and operational efficiency.

- Lower Costs:

The lower transaction fees associated with Bitcoin Cash make it an attractive choice for businesses conducting a high volume of transactions. By minimizing costs, companies can optimize their financial resources and potentially pass on the savings to their customers.

- Global Accessibility:

Bitcoin Cash transcends geographical boundaries, allowing users to send and receive funds across the world without the limitations imposed by traditional banking systems. This accessibility is especially valuable for individuals in regions with limited access to financial services.

- Investment Potential:

As Bitcoin Cash gains wider adoption and recognition, it presents an investment opportunity for individuals seeking exposure to the cryptocurrency market. Its distinct features and potential for growth make it an intriguing asset for those looking to diversify their investment portfolios.

The Impact on the Financial Landscape

Bitcoin Cash has the potential to revolutionize the financial landscape in several ways:

- Innovation and Competition:

By offering a viable alternative to Bitcoin and other digital currencies, Bitcoin Cash fosters innovation and healthy competition within the cryptocurrency ecosystem. This competition drives the development of new technologies and features that benefit users and propel the industry forward.

- Financial Inclusion:

With its low transaction fees and global accessibility, Bitcoin Cash has the potential to empower individuals who have limited access to traditional banking services. By providing a secure and efficient means of transacting, Bitcoin Cash can contribute to financial inclusion on a global scale.

- Disrupting Traditional Systems:

The decentralized nature of Bitcoin Cash challenges the traditional financial systems controlled by centralized institutions. As more individuals and businesses embrace cryptocurrencies, the influence of centralized authorities may diminish, giving rise to a more democratic and transparent financial landscape.

Also Read: 4 Reasons Cryptocurrency is The Future Of Finance

Will Bitcoin Cash reach $1000?

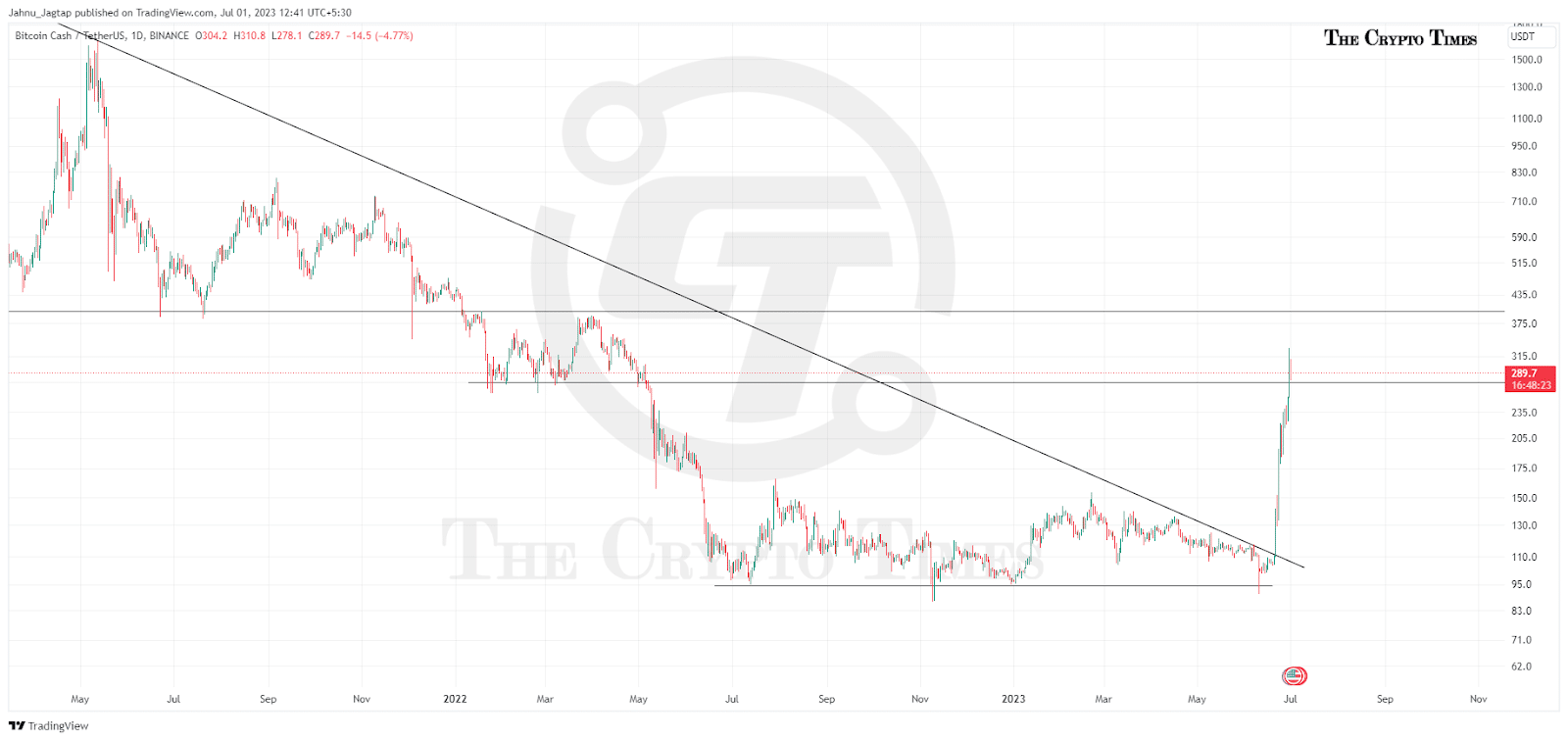

Bitcoin cash remained in deep waters for a year, after entering a downtrend in 2022 with the rest off the market, it traded mostly in the $100 to $150 range. However, the price has surged recently, gaining 50% in a day rendering BCH as one of the top gainers.

The Current BCH price is at $288, climbing over 150% in the last month. With this sudden upward movement it’s raising the interest of more investors to join in. Instinunial backed exchange EDX has also listed it on their platform.

BCH has crossed its first resistive hurdle of 250 very easily with the help of recent price surge. Next resistance for it is at $400, which it can surpass due to recent interest of institutional investors and traders.

Crypto bull markets generally last between 12 to 18 months, so assuming it starts in 2024, its peak can be expected in 2025. With thai bullish scenario BCh can again trade above $1000 and even create a new ATH.

Also Read: Record-Breaking Rise: Bitcoin Cash (BCH) Hits 1-Year High

Conclusion:

Bitcoin Cash represents a significant step forward in the evolution of digital currency. With its enhanced scalability, expedited transaction confirmations, and lower fees, Bitcoin Cash offers a compelling solution to the limitations faced by traditional cryptocurrencies. Its potential to drive financial inclusion, foster innovation, and disrupt traditional systems makes it an intriguing choice for users and businesses seeking a more efficient and accessible means of transacting. As we look to the future, Bitcoin Cash stands at the forefront of reshaping the financial landscape and ushering in a new era of digital currency.