The crypto market was significantly disrupted on November 21st, 2023, following the unexpected announcement of Changpeng Zhao’s (CZ) resignation as the CEO of Binance.

This event, however, was not just a simple change in executive leadership. CZ’s resignation came amidst serious legal challenges, as he pleaded guilty to money laundering charges, leading to a consequential $4 billion settlement with U.S. regulators.

This development sent shockwaves throughout the crypto community, prompting a reevaluation of Binance’s future and its native token, BNB. The news sparked a rapid outflow from the exchange, impacting investor sentiment and the overall stability of the crypto market.

In this article, we delve into the complex dynamics surrounding BNB’s market performance post-CZ’s resignation, analyzing the interplay of legal issues, investor reactions, and the broader implications for the crypto industry.

Immediate Market Reaction To CZ Stepping Down as CEO

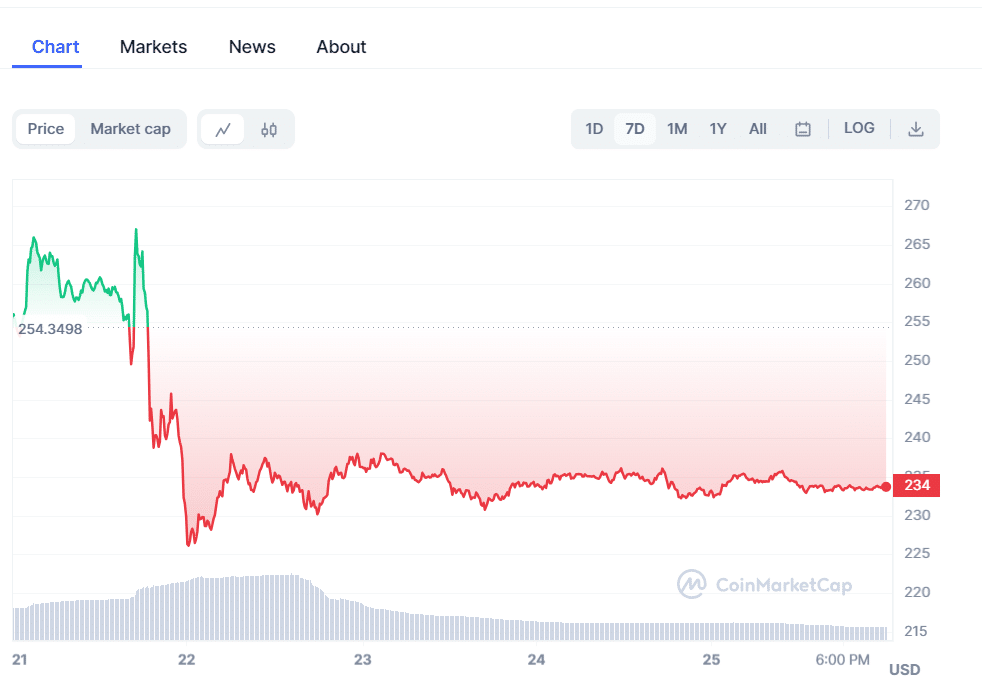

The announcement of CZ stepping down as CEO of Binance on November 21st, 2023, had an immediate and profound impact on the cryptocurrency market, particularly on Binance’s native token, BNB.

BNB experienced a precipitous decline, dropping about 10% from approximately $267 to $240 in response to the news. This sharp drop in value can be attributed largely to the uncertainty and turmoil generated by CZ’s legal issues, including his guilty plea to money laundering charges and the subsequent $4 billion settlement with U.S. regulators.

The market’s reaction was a clear indication of the significant role CZ played in Binance’s operations and the crypto community’s reliance on his leadership. His sudden exit, coupled with the severe legal ramifications, created a sense of instability and unpredictability about Binance’s future.

As the first few hours passed in a blur of red candles and relentless downside volatility, the one-day losses had mounted to over 15%. In terms of price action, BNB had blown straight through key support zones at $244 and $233 with immense bearish momentum.

The immediate sell-off of BNB tokens was a reflection of this sentiment, as investors quickly reacted to the unfolding situation, concerned about the potential long-term implications for one of the world’s largest cryptocurrency exchanges.

BNB’s 15% single-day drop marked its worst daily performance since the March 2020 market crash. Unlike leveraged alts seeing similar outsized moves, BNB’s standing as a market bellwether magnified the panic and negative sentiment.

This event serves as a stark reminder of how sensitive the crypto market is to leadership changes and legal challenges within major cryptocurrency firms. The rapid decline in BNB’s value underscores the fragility of investor confidence in an environment where perceptions of stability and reliability are paramount.

Factors that contributed to BNB’s Price Decline

1. CZ’s Resignation

The primary catalyst behind BNB’s downward spiral was the market uncertainty triggered by CZ’s surprise decision to step down as Binance CEO. His statement took the crypto world by storm and suggested internal troubles at Binance. As the founder and longtime face of Binance, CZ has come to embody the brand’s identity and success. His departure left investors questioning Binance’s future strategic direction.

2. Leadership Transition Fears

BNB holders were rattled by fears that Binance could struggle with leadership changeover. As a centralized exchange, Binance relies heavily on its founder’s vision. CZ had played an instrumental role across Binance’s products, regulatory dealings, BNB tokenomics and more. There were apprehensions that his successor may not match his execution abilities.

3. Regulatory Headwinds

Binance has already faced regulatory scrutiny over compliance issues across multiple jurisdictions. However, CZ’s political stature and industry relationships helped allay crackdown concerns. Until recently, he was charged with money laundering.

These mounting regulatory troubles weighed heavily on BNB prices.

4. BTC and Crypto Market Weaknesses

The turmoil around CZ exiting came at a time when crypto markets were already nursing losses from FTX’s collapse. Skittish crypto investors capitalized on the CZ news to reduce portfolio risk. BNB’s downward move aligned with weakness in Bitcoin, altcoins and stablecoins as traders converted holdings to stable fiat.

Also Read : CZ’s Exit from Binance: Is it the End of an Era or a Fresh Start?

BNB Market Outlook: Recovery Timeframe and Price Predictions

According to CoinMarketCap, BNB was down by more than 8% over the last seven days. However, the token has been on the recovery train, targeting $300 as Chanpeng Chao leaves the exchange.

This shows a bullish outlook for the exchange. It is possible that if holders stop selling the token, it will climb back to $270 quickly and also bring back a high level of sales of $300 in no time.

Several analysts also believe the positive fundamentals will allow BNB to reclaim the psychologically important $400 level within the next 2-3 months. However, conservative predictions set BNB’s year-end price target near $380.

Barring any black swan events, these projections indicate that BNB’s post-CZ sell-off could merely end up as a short-lived blip rather than a long-term bear cycle. With Binance’s operations now decentralized across regions, change at the top is unlikely to disrupt business continuity.

The positive developments and technical resilience have led experts to suggest complete normalization by Q1 2024. As per the laid out growth plans, BNB is forecast to trade around $700-800 in a year’s time.

Factoring in a crypto bull run, the token could even revisit all-time highs nearing $690 over the same period. So while uncertainty persists in the interim, BNB remains fundamentally well-positioned.

Impact on Broader Crypto Market Cap and Altcoins

Exposing Crypto’s Key Weaknesses

The latest bout of volatility has reignited criticism about the over-reliance of crypto firms on founding personalities rather than institutions. The perceived instability following CZ’s exit and FTX’s collapse dented institutional confidence in decentralized networks’ resilience against black swan episodes.

Moreover, the considerable regulatory leeway enjoyed by earlier crypto leaders is narrowing across G20 nations. As global regulatory scrutiny intensifies, crypto firms can no longer depend on top executives’ political capital to smooth legal roadblocks. This indicates limited elbow room for smaller cap tokens to manoeuvre through jurisdictional uncertainties going forward.

However, the developments have also highlighted the strengths of the leading blockchain networks. Despite recent Flash crashes, the robust infrastructure and validator mechanisms underlying Bitcoin and Ethereum confirm their antifragility against isolated shock events. The core promise of decentralization remains as pertinent as ever.

Strong Fundamentals Support Sustainable Growth

Industry experts seem convinced that the broader foundation for exponential crypto adoption remains firmly intact. The growing Web3 development activity and real-world utilization cases will continue to attract users and investors alike.

For instance, Ethereum’s primed merger transition to proof-of-stake validates its energy efficiency edge for sustainability-focused institutional capital.

Once risk perceptions stabilize, the crypto market cap is expected to reverse its decline and maintain its upward trajectory in line with adoption roadmaps. Leading networks and tokens like BNB with strong business fundamentals can shake off current uncertainties to post 30-40% gains in 2024 itself on the back of a maturing bull market.

Conclusion:

The abrupt resignation of Changpeng Zhao has undoubtedly rocked crypto’s leading exchange, Binance and almost brought its native BNB token to its knees.

However, Binance’s global scope and extensive product suite spanning trading, DeFi, NFTs, and payments provide it with the resilience to maintain operations amidst leadership changes. Proactive measures to stabilize BNB prices also reinforce Binance’s financial commitment to protecting user interests.

BNB’s fundamentals remain largely intact, with network activity and volumes rising steadily over the past year. As new CEOs settle in and volatility simmers down, BNB looks on track to reclaim its key support levels. The developments could also catalyze industry-wide governance reforms by reducing founder-level risks.

For decentralized blockchain flagships like Bitcoin and Ethereum, short-term price manoeuvres remain enslaved to overall market conditions. Despite recent upheavals exposing structural weaknesses, their core value proposition and real-world utility continue to shine through.