Developments in crypto transactions have been made to ensure fast and cost-effective transactions. Solana is one of those projects trying to break that record.

Amid the cut-throat competition from other blockchains, Solana is setting the pace for what is possible when it comes to cryptocurrency performance.

The Solana blockchain was created to host decentralized applications (dApps) with performance enhancement and scalability. It is an open-source network founded in 2017 that processes transactions at significantly lower fees. Solana strives to take on the second-largest blockchain network, Ethereum.

In this guide, we will examine how Solana is redefining cryptocurrency transactions, how it is attracting many projects, and how it can achieve speed, usability, and scalability.

Also,we will dig deeper into what makes this chain special, with a particular focus on Solana nodes, which see growing interest among the developer community on par with Ethereum nodes.

Solana Blockchain Positioning on the Crypto Domain

One thing that stands out for Solana is that the project presents itself as a high-performance Layer 1 blockchain. The project aims to offer speed, scalability, and low-cost transactions to its users.

But the question is, what differentiates it from other blockchains in the crypto domain?

The answer lies in its appealing promise of performance enhancement of the blockchain ecosystem.

1. Scalablity

Solana positions itself as a leading network designed for flexible speed expansion as more validators join the project.

This implies that the more transactions performed on the platform, the more Solana will be scalable and faster. Therefore, with this, there is no limit to Solana’s growth.

2. Speed

Solana’s speed is just the beginning. As earlier said, the project is designed to increase speed as more validators process transactions.

As it is, Solana can process over 5,000 transactions per second.

However, some analysts say that theoretically, it can process up to 65,000 transactions per second, although this has only been achieved in test net conditions.

The beauty of this is that Solana positions itself as one of the projects that can ensure fast payments for its users as well as applications built on it in less than 0.01 seconds.

3. Ecosystem

Solana’s ecosystem is large. This platform accommodates other projects across Dapps, DeFi, NFTs, Web3, and a lot more.

This community makes Solana appealing to both start-up organizations and investors, as well as crypto-savvy investors.

4. Low Fees

Solana is one of the cheapest, most affordable, and most efficient networks out there. A single transaction conducted on the platform can cost you about $0.00125.

Some transactions on Solana might incur additional fees when users want to boost their transactions against other users for quick execution.

Thanks to Solana’s Proof-of-History (PoH), and its Proof-of-Stake (PoS), the platform has been able to peg transaction costs to a fraction of a penny.

Solana Nodes and Their Role in the Ecosystem

Solana nodes are the many computers that help the Solana software run effectively to make sure that transactions conducted on the platform are validated and secure.

There are different types of nodes and they function differently. They include:

Validation Nodes

These sets of computers are responsible for ensuring the smooth processing of transactions.

Because of these nodes, Solana’s Proof-of-History combined with its Proof-of-Stake makes it possible for each transaction to be recorded by reaching a consensus on the state of the ledger.

Talking about speed, these validators also help Solana reach its maximum capacity and over 1000 validators Participate on the Solana Network Worldwide.

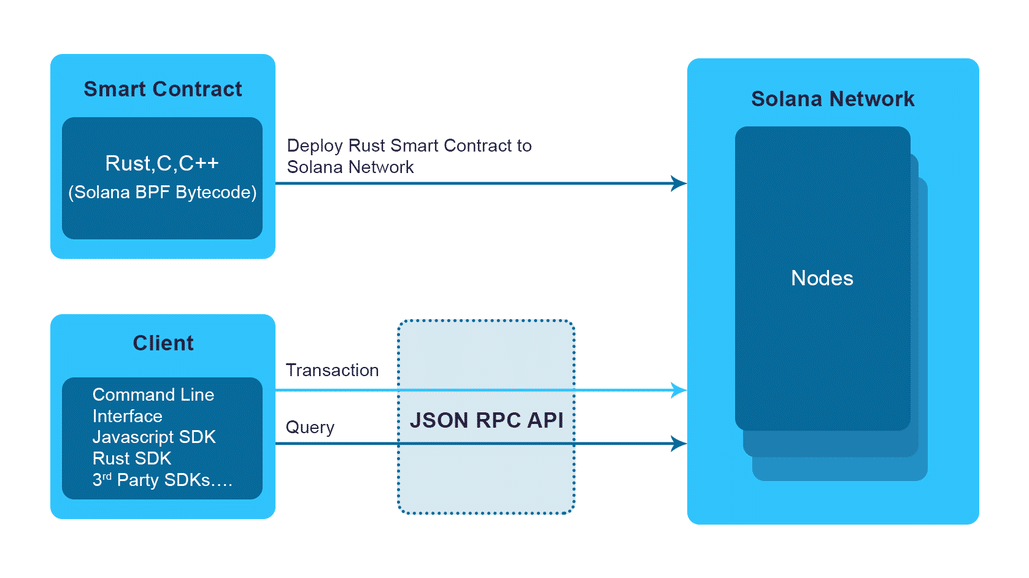

Solana RPC Node

In addition to allowing users to submit new transactions, an RPC node replies to network-related queries.

To provide customers who desire to engage with the Solana blockchain with a particular dApp or service (such as decentralised exchanges), fleets of RPC nodes are typically present.

Also, instead of forcing Solana dApps to stay in charge of their node structures, which is expensive in regards to both time and money, Solana RPC node operators make it simple for programmers to send requests to and get payloads from nodes on Solana’s network.

Solana vs Ethereum Comparision

In comparing Solana to Ethereum, there are a lot of things to consider. Although these two blockchains are somehow similar in structure.

But, Solana was built to improve on the lapses of Ethereum. Here are some differences:

| Solana | Ethereum | |

| Market Cap | Solana has a market value of roughly $7.69 billion and is a relatively young cryptocurrency. By market cap, it continues to be one of the top 10 altcoins. |

With an estimated market cap of roughly $194 billion, Ethereum is the second-largest cryptocurrency currently in circulation (after Bitcoin). |

| Innovation | Solana implemented a proof-of-history procedure along with proof-of-stake to verify payments. Solana is one of the swiftest blockchains on the market thanks to this innovative technology. Therefore, it is fast and innovative |

Ethereum switched from an energy-intensive proof-of-work system to a more sustainable proof-of-stake mechanism in September 2022. This, therefore, makes the platforms sustainable. |

| Transaction Cost | With the technologies it employs, Solana can process transactions more quickly. This has resulted in continuously reduced transaction costs. At Solana, most transactions only cost a small fraction of a cent. |

Transaction fees may increase using Ethereum’s proof-of-work algorithm as users contend for block space for verifying payments. Usually, transaction charges are under $1, but they have occasionally exceeded $70 |

| Pricing | Investment in SOL is now more accessible because Solana is still expanding. | Ethereum, the next-most widely used digital currency, is fairly pricey. |

Use Cases of Solana

Numerous projects are based in Solana and make use of its scalability and flexibility. The blockchain has been put to innovative use by developers. Several of its use cases are listed below.

1. Decentralized Finance (DeFi)

Decentralized financial (DeFi) companies offer a wide range of financial products and services via the Internet without relying on traditional banks.

Examples of DeFi include digital wallets, automated trading systems, and decentralized exchanges (DEXs).”

Orca and Serum are two examples of Solana-based DEXs that let users exchange cryptocurrency without requiring any kind of custody. Stablecoins like Sabre, which offer customers a liquid alternative to cross-cryptocurrency margin trades, are built on the foundation of Solana.

2. Lending Protocol Functions

Systems that enable users to make deposits or lend money over the blockchain known as Solana have been developed by a few programmers.

Users have the option to set up automatic repayments or earn interest. Solend and Apricot Finance are two examples.

3. NFT Applications

NFT apps that let users mint and sell digital art have been developed using Solana. Users have the option of developing customised NFT products and stores, as well as integrating NFTs into other programs like games.

Metaplex and Solanart are two instances of Solana NFT marketplaces.

4. Web3 Applications

New apps that make use of the newest internet technology are among the most intriguing advancements on the Solana blockchain. The apps are also decentralized, making them dependable and accessible to all online users.

Also Read: Taking DeFi to the Next Level: A Comprehensive Look at Radix DLT

Final Thought

Blockchain technology is ever-evolving and we are yet to see the last of it.

Solana provides traders and developers with extremely quick, scalable solutions that let them offer a variety of services to online users all over the world. The possibilities for developers are virtually endless.