Bitcoin, the groundbreaking cryptocurrency, has revolutionized the financial system. It has captivated the attention of investors, technologists, and enthusiasts across the globe. Among its many fascinating features, one that stands out is the occurrence of a periodic event known as “Bitcoin Halving.”

Since its inception, Bitcoin has intrigued the world with its decentralized nature and scarcity-driven design. At the heart of this innovative system lies the concept of Bitcoin halving, an event that occurs approximately every four years. This halving mechanism reduces the rate at which new bitcoins are created by half approximately every four years, ensuring a limited supply and decreasing the impact of inflation. This deliberate mechanism ensures that the production of Bitcoins gradually decreases over time, ultimately capping the total supply at 21 million coins. Bitcoin Having a limited supply has its own benefits and drawbacks.

The phenomenon of Bitcoin halving has far-reaching consequences, affecting various aspects of the cryptocurrency ecosystem. In this article, we will explore the historical occurrences of halving events and their impact on key metrics such as mining rewards, network security, and price dynamics.

What Is Bitcoin Halving?

Bitcoin Halving is a significant event that takes place roughly every four years or after the completion of 210,000 blocks in Bitcoin blockchain networks. During this event, the block reward, which is the incentive given to miners for verifying transactions, is reduced by exactly 50%.

Bitcoin’s design is based on a decentralized network where transactions are verified by miners through a process called mining.

The block height at which the halving occurs is predetermined and encoded in the Bitcoin protocol. As the next event takes place every four years, Bitcoin’s next halving date is expected to be in April or May 2024.

Initially set at 50 bitcoins per block, each halving reduces the reward by half, leading to a gradual decrease in the rate at which new bitcoins are created. As of the most recent halving in 2020, the block reward is 6.25 bitcoins.

So when does this historic event of the Bitcoin halving happen? Let’s get to know it.

When Does Bitcoin Halving Happen?

Bitcoin halvings occur at regular intervals of four years to maintain a predictable supply schedule and control inflation, which is the ideal timeline for 210,000 block generation.

Now, the question can arise in one’s mind why does it happen after four years? So, here’s an answer.

The ideal time for generating one block in Bitcoin is around 10 minutes. Approximately every four years, after about 210,000 blocks are generated, Bitcoin’s halving mechanism is triggered.

This mechanism helps to decrease the rate at which new bitcoins are created, which helps control inflation and maintain a stable supply of bitcoins. This interval allows for a predictable and gradual decrease in the issuance of new bitcoins, contributing to the controlled supply and countering inflation.

But rather than finding the answer to when Bitcoin halving happens, it is more important to question why it happens and why it is needed.

Why does Bitcoin Halving happen?

To get to know why Bitcoin halving happens, we need to dig deep into the mechanism of the Bitcoin transaction verification process.

The mechanism behind Bitcoin halving is rooted in the underlying technology of Bitcoin, known as the blockchain, and the consensus algorithm it follows. The Bitcoin network is currently using the Proof-of-Work (PoW) consensus algorithm to verify transactions.

In the Bitcoin network, miners use powerful computers (also known as Nodes) to solve complex mathematical puzzles to validate and secure transactions. When a miner successfully solves a puzzle, they add a new block of transactions to the blockchain and are rewarded with newly minted bitcoins.

Initially, when Bitcoin was launched in 2009, the block reward for miners was set at 50 bitcoins per block. However, as part of its design, the Bitcoin protocol included a rule that the block reward would be cut in half approximately every 210,000 blocks.

Returning to our main question, why does the Bitcoin halving process occur? So, here is an answer.

Bitcoin halving process cuts block rewards to achieve two purposes:

1. Controlled Supply

By halving the block reward, the rate at which new bitcoins are created is reduced. This ensures that the total supply of bitcoins remains limited and finite. The maximum supply or limited supply of bitcoins is capped at 21 million, and the halving events gradually reduce the rate of issuance until this limit is reached.

2. Scarcity and Value

The controlled supply of bitcoins helps maintain scarcity, which, in turn, can affect its value. With a decreasing rate of new supply, if the demand for bitcoins remains constant or increases, it can lead to an increase in the price of each bitcoin on exchanges like bitcoin.com.au. It simply follows the economic principle of supply and demand.

Bitcoin Halving Dates & Next Bitcoin Halving

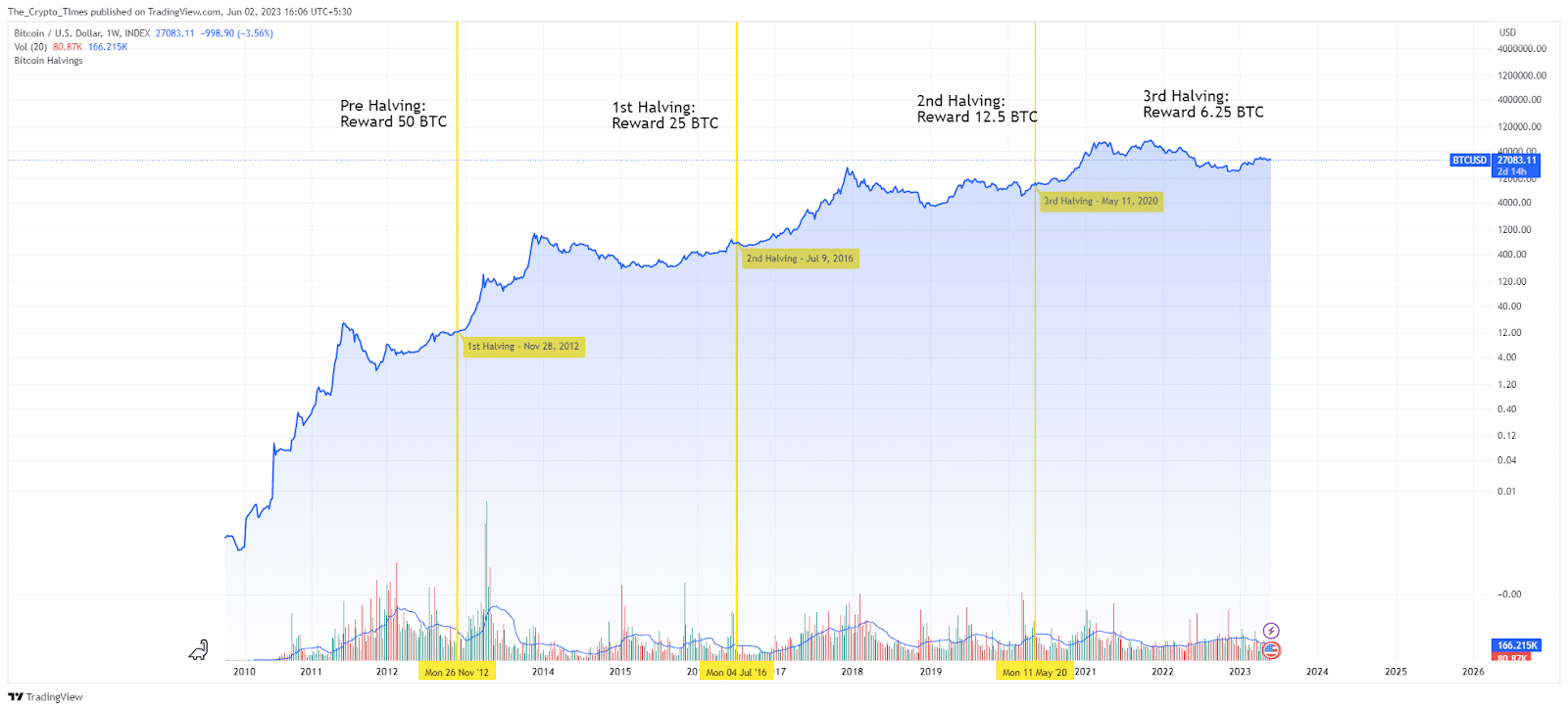

Bitcoin’s first halving event took place in 2012, approximately three years after its creation. The second halving occurred in 2016, and the most recent halving happened during the Covid-19 pandemic surge in May 2020 despite all the FUD around it. The next halving event is about to take place in 2024 at 840,000 block height. These events mark significant milestones in Bitcoin’s history, affecting its supply dynamics and overall market sentiment. Here is the list of Bitcoin halving dates.

| States | Timeline | Block Height | Reward |

| Bitcoin Introduced | 3 Jan, 2009 | 0 | 50 BTC |

| 1st Halving | 28 Nov, 2012 | 210,000 | 25 BTC |

| 2nd Halving | 9 July, 2016 | 420,000 | 12.5 BTC |

| 3rd Halving | 11 May, 2020 | 630,000 | 6.25 BTC |

| 4th Halving | 2024 (Expected Between April-May) | 840,000 | 3.125 BTC |

| 5th Halving | 2028 | 1,050,000 | 1.5625 BTC |

The Effect of Halving on Bitcoin Price

Bitcoin halving events are significant milestones in the cryptocurrency’s history and are closely monitored by the community due to their potential impact on the supply dynamics and price of Bitcoin.

The bitcoin halving plays a significant role in the Bitcoin cycle. By reducing the block reward, halving creates scarcity, reinforcing Bitcoin’s value proposition as a deflationary asset. The reduction in the rate of new bitcoin issuance has historically been associated with increased attention and demand, potentially driving up the price. It also puts pressure on miners, as their rewards are reduced, necessitating efficient operations and potentially leading to consolidation within the mining industry.

How is Bitcoin Price Affected By Bitcoin Halving?

Bitcoin halving events have historically had a significant impact on the price of Bitcoin, although the effects may not be immediate. Examining the past three halving events provides valuable insights into the price dynamics surrounding these events.

Typically, a notable price increase occurs between six to twelve months after a halving event.

Moreover, leading up to a halving, the price of Bitcoin tends to rise as investors anticipate a post-halving price rally. However, it is important to note that the circumstances surrounding each halving event are unique, and thus, the occurrence of a price rise cannot be guaranteed.

The halving directly impacts the price of Bitcoin in the following ways:

- Reduced Rewards: The halving reduces the rewards miners receive for verifying transactions, promoting a healthier and more sustainable growth of the network. By diminishing the rate at which new bitcoins are generated, the halving ensures that Bitcoin’s supply remains limited and finite, potentially helping to maintain its value over time.

- Decreased Inflation Rate: After a halving event, the inflation rate of Bitcoin decreases as the supply of new coins entering the market is reduced. This reduction in inflation can lead to higher demand for Bitcoin, potentially driving up its price.

The impact of Bitcoin halving on its price is a topic of debate among market analysts and participants. Some believe that the halving will cause a significant price increase due to the reduced inflation rate, leading to higher demand and a corresponding rise in value.

Let’s take a closer look at the historical halving events:

- 2012

The first halving occurred on November 28, 2012. This event slashed the Bitcoin block reward from 50 BTC to 25 BTC. Within a year, the price of 1 BTC surged from $12 to around $1,031.95, representing an increase of over 8,500%. By this point, 210,000 blocks had been mined, and half of the total number of bitcoins (10.5 million) had been released into circulation.

- 2016

The second halving, eagerly anticipated in the crypto community, took place on July 9. By the time the 420,000th block was mined, the Bitcoin block reward had been halved again to 12.5 BTC. Bitcoin was trading at $650.96 at that time. Following a short-term retreat, the price of one bitcoin reached an all-time high of $20,089 after 526 days after the halving event.

- 2020

The most recent halving occurred on May 11 amidst uncertainties, including the impact of the COVID-19 crisis, which caused the price of Bitcoin to crash in March. The halving reduced the block reward from 12.5 to 6.25 BTC at the 630,000th block, with Bitcoin trading at around $8,787/BTC. Approximately 18 months later, Bitcoin reached a peak of around $69,000.

Also Read: Bitcoin Price Prediction 2023: Will Prices Surge or Slump?

Will BTC Price Rise After The 2024 Bitcoin Halving?

So, while the Bitcoin network is on the verge of the next Bitcoin halving event, there is so much excitement built around its effect on BTC prices. It’s difficult to say how exactly it will affect BTC prices. However, if we look at the last three Bitcoin halving events, there’s been a rally in the BTC price after the Bitcoin reward was cut in half. But the year 2024 could act differently, as the crypto market is still emerging from the historical devastation of 2022. BTC is already struggling to break $30K support, proving the wrong price predictions from experts.

Though many experts believe that the 2024 Bitcoin halving event will bring a rally in BTC price and take it to a new all-time high. Ultimately, it depends on various factors such as market sentiment, macroeconomic conditions, and regulatory developments.

What Will Happen To Bitcoin After Bitcoin Halving 2024?

The Bitcoin halving in the spring of 2024 will reduce the mining reward which is currently 6.25 BTC to 3.125 BTC. The Bitcoin halving highlights the potential and the scope for blockchain technology and also holds the promise of shaping Bitcoin’s future as it continues to impact market dynamics, and potentially leading to increased scarcity and price appreciation.

What Happens When There Are No More Bitcoins Left?

We all know that Bitcoin’s design envisions a finite supply of 21 million bitcoins. Once all bitcoins have been mined, which is estimated to occur in the year 2140, transaction fees will become the primary incentive for miners. There will be no mining rewards for miners to mine new Bitcoins.

Instead, miners will rely on fees paid by users to prioritize and include their transactions in the blockchain. This transition promotes the sustainability of the network while still allowing for secure and efficient transactions.

Furthermore, after all Bitcoins have been mined, the primary source of income for miners will be transaction fees, as Bitcoin mining rewards will be eliminated. It is likely that transaction fees will increase as miners rely more on fees to sustain their operations. The reason behind this could be congestion on the network or the departure of miners from the network, as their main incentive of mining rewards will no longer be there. Although market conditions and competition will ultimately determine the specific fee levels.

Why It Matters

Bitcoin halving events have far-reaching economic implications. The reduction in the block reward reinforces Bitcoin’s deflationary nature, making it a potential long-term store of value. Additionally, halvings generate increased public awareness and interest in cryptocurrency, driving its adoption and mainstream acceptance. Halving events have historically been followed by bull markets, leading to significant price increases and sparking new waves of enthusiasm among investors.

Conclusion:

Bitcoin halving represents a significant milestone in the cryptocurrency’s journey, highlighting its unique economic model and supply dynamics. As each halving event unfolds, it continues to shape the landscape of digital finance. Understanding the technical intricacies and economic implications of halving helps investors and enthusiasts appreciate Bitcoin’s long-term potential and its role in revolutionizing the world of money and transactions.

FAQs

1. How can I trade the Bitcoin halving?

Trading the Bitcoin halving involves speculating on the price movements of Bitcoin before and after the halving event. You can participate in trading by using cryptocurrency exchanges that offer Bitcoin trading.

2. Can I make money from the BTC halving?

The Bitcoin halving can present opportunities for profit, but it’s important to note that trading any financial asset, including Bitcoin, carries risks. Some traders aim to profit from price fluctuations by buying Bitcoin before the halving and selling it afterward if they anticipate a price increase.

3. What will the BTC price be after the halving?

Predicting the exact price of Bitcoin after the halving is challenging and uncertain. The halving event is typically followed by increased market attention and speculation, which can impact the price.

4. How do I reduce the risks of trading Bitcoin?

To reduce the risks associated with trading Bitcoin, consider the following strategies:

- Educate yourself

- Develop a trading plan

- Use proper risk management

- Stay updated

- Start with a small investment

5. What month is the next Bitcoin halving?

The Bitcoin Halving is expected to take place in April or May 2024.

6. Will Bitcoin Price Drop After Bitcoin Halving?

As of now, there’s no concrete evidence are present that support drop in the Bitcoin price after Bitcoin halving events.

7. How many Bitcoin halvings are left?

The total bitcoin halving count is 32 and as of now (2023) three bitcoin halving has been occurred. It means 29 Bitcoin halving are still left.

8. Does Ethereum has halving?

No, the Ethereum blockchain does not have a halving event.

9. Which crypto has halving?

Crypto-halving event occurs in several cryptocurrencies like Bitcoin (BTC) along with Litecoin (LTC), Bitcoin Cash (BCH), Bitcoin SV (BSV), Dash (DASH), Zcash (ZEC), Decred (DCR), Vertcoin (VTC), Digibyte (DGB), Halcyon (HAL).

10. Is Bitcoin Halving good or bad?

Bitcoin halving happens for a good cause as it enhances the scarcity of Bitcoin, consequently increasing its value in theory.